How to file for a free LLC agreement [Guide]

Table of Contents

- Can I create my own operating agreement?

- How do I set up an LLC in Oklahoma?

- How do I transfer ownership of an LLC in Oklahoma?

- How do I add a member to my LLC in Oklahoma?

- How much does an LLC cost in Missouri?

- How do I set up an LLC in Missouri?

- What taxes does an LLC pay in Missouri?

- Is law Depot legitimate?

- What is a LLC business?

- What are the advantages of the LLC form of Organization?

- Which one of the following should be contained in an operating agreement for an LLC?

- How do you write a simple operating agreement?

- Is articles of organization the same as operating agreement?

- Does Oklahoma require an operating agreement for LLC?

- Does Missouri require an operating agreement for an LLC?

- How do I create an operating agreement for an LLC?

- What should an operating agreement include?

- How is LLC ownership divided?

- How are profits divided in an LLC?

- Do LLC distributions have to be equal?

Last updated : Sept 2, 2022

Written by : Olin Schnoor |

Current |

Write a comment |

Can I create my own operating agreement?

Although you're able to make an Operating Agreement at any time, it's often best to make one at the very beginning to help guide all business decisions. An LLC Operating Agreement can be for a single-member or multi-member LLC.

How do you write a simple operating agreement?

- Basic information about the LLC.

- A profit and loss allocation plan.

- The LLC's purpose.

- The management structure.

- Ownership percentages of each member.

- Voting rights and procedures.

- Meeting frequency.

- Procedures for bringing in new members.

Does Oklahoma require an operating agreement for LLC?

There is no Oklahoma law requiring LLCs to adopt a written operating agreement. According to 18 OK Stat § 18-2001.16 (2019) an operating agreement can be any agreement between LLC members, whether oral, written, or implied.

Does Missouri require an operating agreement for an LLC?

In addition to articles of organization, Missouri statute requires all limited liability companies to have an operating agreement.

How do I create an operating agreement for an LLC?

- Step One: Determine Ownership Percentages.

- Step Two: Designate Rights, Responsibilities, and Compensation Details.

- Step Three: Define Terms of Joining or Leaving the LLC.

- Step Four: Create Dissolution Terms.

- Step Five: Insert a Severability Clause.

What should an operating agreement include?

- Percentage of members' ownership.

- Voting rights and responsibilities.

- Powers and duties of members and managers.

- Distribution of profits and loses.

- Holding meetings.

How is LLC ownership divided?

Members usually receive ownership percentages in proportion to their contributions of capital, but LLC members are free to divide up ownership in any way they wish. These contributions and percentage interests are an important part of your operating agreement.

How are profits divided in an LLC?

The business does not pay entity-level taxes. Instead, the company passes profits and losses through to you and the other members. The LLC allocates profits to members based on their ownership percentage or based on a special percentage allocation as agreed upon by the members.

Do LLC distributions have to be equal?

Do partnership distributions have to be equal? Partner equity does not typically equate to equivalent investment contributions from all business partners. Instead, partners can make equal contributions to the company and possess equal ownership rights, but make contributions in a variety of different forms.

How do I set up an LLC in Oklahoma?

- Choose a Name for Your LLC.

- Appoint a Registered Agent.

- File Articles of Organization.

- Prepare an Operating Agreement.

- Comply With Other Tax and Regulatory Requirements.

- File Annual Certificate.

How do I transfer ownership of an LLC in Oklahoma?

To transfer LLC ownership in Oklahoma, the member has to transfer vested ownership rights. The majority of the members of the LLC, if any, must consent to the transfer in writing. That is, unless the LLC's Operating Agreement specifies otherwise.

How do I add a member to my LLC in Oklahoma?

Oklahoma LLCs that want to process amendments have to file an Amended Articles of Organization of an Oklahoma Limited Liability Company form. You can submit it to the Secretary of State by fax, mail, or in person. Oklahoma also allows online filing through the website of the Secretary of State.

How much does an LLC cost in Missouri?

How much does it cost to form an LLC in Missouri? The Missouri Secretary of State charges $50 to file the Articles of Organization online and $105 for paper filings. Online Filers must also pay an additional $1.25. You can reserve your LLC name with the Missouri Secretary of State for $7.

How do I set up an LLC in Missouri?

- Name your Missouri LLC. Give your Missouri limited liability company a name.

- Appoint a registered agent in Missouri. Name a registered agent for your LLC.

- File Missouri Articles of Organization. File Articles of Organization with the Missouri Secretary of State.

- Create an Operating Agreement.

- Apply for an EIN.

What taxes does an LLC pay in Missouri?

Missouri has a very straightforward tax code for LLCs. The rate is 6.25 percent of taxable income. In addition to federal taxes, LLCs also have to pay employer taxes. Some of these taxes are paid to the federal government and others are paid to the state.

Is law Depot legitimate?

LawDepot is accredited with the Better Business Bureau with an A+ rating. Customers who left Law Depot reviews online say that the service is educational and easy to use. Sequiter Inc, Law Depot's parent company, runs this resource. Under their guidance, this site has enjoyed an excellent online reputation.

What is a LLC business?

A Limited Liability Company (LLC) is a business structure allowed by state statute. Each state may use different regulations, you should check with your state if you are interested in starting a Limited Liability Company. Owners of an LLC are called members.

What are the advantages of the LLC form of Organization?

An LLC's simple and adaptable business structure is perfect for many small businesses. While both corporations and LLCs offer their owners limited personal liability, owners of an LLC can also take advantage of LLC tax benefits, management flexibility and minimal recordkeeping and reporting requirements.

Which one of the following should be contained in an operating agreement for an LLC?

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on ...

Is articles of organization the same as operating agreement?

The Articles of Organization are state mandated and therefore are required by law while Operating Agreements are typically not required by law. The Operating Agreement aids in the wrap up of the LLC while the Articles of Organization will not since they are made to just establish the business.

Check these related keywords for more interesting articles :

The cost of forming an LLC in arkansas

Can an llc buy another llc lookup

Real estate investing LLC name ideas snpmar23

Spruce power 3 LLC dallas tx website

Different ways an llc can be taxed

LLC must know korean phrases

How to sign a check for an LLC

California llc annual report fee

Tax exempt business LLC

Which LLC get 1099 from coinbase to metamask avax

Should i form an LLC for rental property

Cost to file llc in wyoming

Things to do with LLC set

Can a medical practice be an llc

How to change llc name in california

Did you find this article relevant to what you were looking for?

Write a comment

Comment by Jefferey Apruzzese

you want to know how to write an llc operating agreement now i'm going to walk you through how to do it step by step starting right about now hey if you're new to the channel i'm quran from life accounting the number one firm for small business financial education be sure to give this video a like to help other small businesses see it and subscribe to the channel so you don't miss out on future videos and if you have a quick question or just want to say thank you for the video be sure to leave a comment below now quick disclaimer this is not legal advice and you should get your operating agreement checked by an attorney of your choice okay let's start by answering the question what is the operating agreement and why is one important well an operating agreement is a legally binded document that outlines in detail the rights and responsibilities of the members of the llc and how the business will operate now some states don't require you to have an operating agreement but i suggest you always create one to minimize any misunderstandings and disputes operating agreements make it very very clear how the business will operate and can be referenced later on in times of uncertainty such as member withdrawal equity and distribution splits signing of contracts member deaths and more if you do not have an operating agreement the default llc rules of your state will apply which may differ from what you have in mind for your own business okay now that we understand what an operating agreement is and the importance of one let's walk through a template to help you write one for your own company this will be a good starting point for your own operating agreement as it includes almost all if not all clauses recommended in most agreements okay the first step is to go to law depot.com i'll leave a link for it in the description below so you don't got to go searching for it then you want to go to business at the top and then llc operating agreement all right so we're going to start creating the llc operating agreement note that it asks you where is this company registered and that's because it's going to want to create an llc operating agreement that is specific to your state so for me i'm going to leave it on georgia then i'm going to go to save and continue next is going to ask you will your company perform professional services so if your company performs a service such as cleaning right then you're going to want to click yes if you are just say e-commerce business then you would click no for me i'm going to click no all right and then it's going to ask you what is the primary purpose for this company now for my company quran's toys um you can make something general and something broad typically works okay so i'm going to say i so toys next is going to ask you for your company name so go ahead and put your company name there then where is the company principal office located okay so wherever your company is located if you have an office then you put the office address if you work from you know your home then you put your home address all right so it's asking for the street all right so you put your address in now save and continue okay next is going to actually will this company have more than one class a member so in the llc your members are the owners and when it asks you if you want to have more than one class of members more than one class of owners it's asking you if you want to have different say subsections of owners each having their own different rights and responsibilities and obligations and that is up to you if you'd like to do that for me and karan's toys i'm going to say no all right next is going to ask you who are the members aka the owners of the llc note that with the llc you could have different types of owners you could have actual people or individuals a corporation can own an llc and then a you could have a partnership trust or another llc can own the llc so for me i'm going to say individual and all right so i am one of the owners right so go ahead and put your name there or i'm going to go ahead and put my name and you can put your address if you like if you have more than one member for your llc so say you're a multi-member llc right not a single member then go ahead and add all of the members and my partner's name is john doe all right and karan's toys so you have your members and you want to go down and click save and continue now a capital contribution is anything that and member contributed to getting the business started now note this can be money this can be time this can be things such as equipment right whatever you contributed whatever member contributed to get the business started you place it here so me i contributed say five thousand dollars in cash right and you want to put a total value here the five thousand dollars and my partner john doe contributed equipment with a total value contribution of say five thousand dollars all right so once again cash capital contributions are anything that you contributed to getting the business up and running right once you have that in there click save and continue so next question could additional contributions be required in the future well what does that mean well we can go over here to the frequently asked questions and figure out right so choosing yes means that members can vote to increase the overall level of capital contributions in line with business needs and require additional investments from its members so if you say yes then you are basically saying that if the business needs more money right if you vote to increase the cash capital contributions then basically they're required to right your members are required to fulfill that obligation if you choose no then let's see what it means choosing no means any additional money invested in the company by a member aka owner is treated as a debt owed by the company to the owner this means that members original share in profit and loss and in distribution will be maintained so this does not affect equity but is basically seen as almost like a loan to the business from one of the members okay so i'm gonna click no now we're gonna get into if you're able to add new members to to their llc all right can a new member be admitted later i'm going to say no all right this is up to you but i'm going to go ahead and say no all right can a member voluntarily withdraw from the company that is up to you um i personally believe that if you're in business with somebody and you choose to do business with someone that you can't just voluntarily leave we're gonna have to work it out together or figure out you know how to go about that situation so i'm gonna click no okay but if you have any questions about why you should restrict members then you can you can you know look at this frequently asked questions here and they have a good point the success of your llc depends on the participation of all members right that's why you might not want to have a member voluntarily withdraw from the company i agree let's talk about member meetings so llcs are required to hold regular meetings right to discuss a business and you can put in your operat

Thanks for your comment Jefferey Apruzzese, have a nice day.

- Olin Schnoor, Staff Member

Comment by Wilber

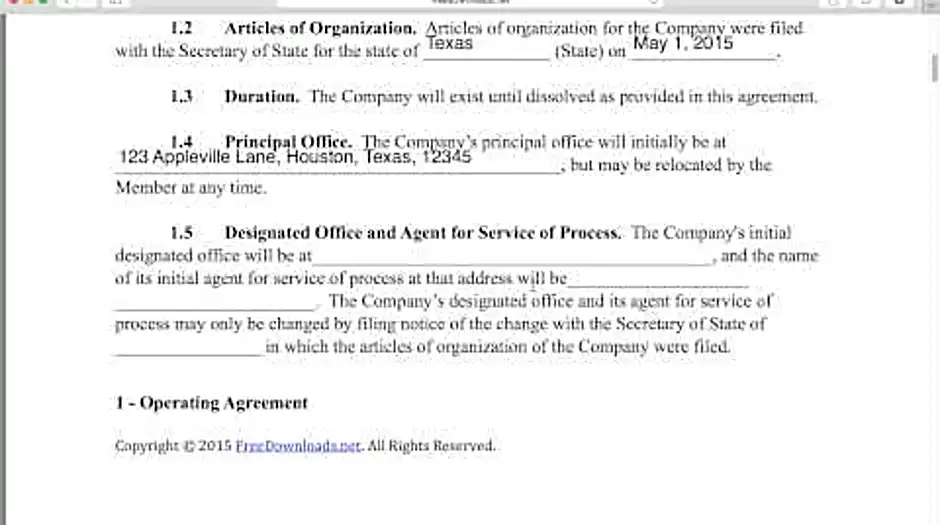

hi and we're going to show you how to write a single-member LLC operating agreement now what is a single-member LLC operating agreement it is a form that is used with every LLC that is formed in all states is the only form that states who the owners in this case who the owner is of an LLC and it is even though you may be saying well I'm a single member I'm gonna be listed as the only member at the state level as you can see it is required in these states California Delaware Maine Missouri and New York even if you are a single member and it's a very important document to help prove your personal assets from your business assets because pretty much if you have an LLC that doesn't have an operating agreement and someone tries to question that authorities such as the IRS is being a separate entity from your personal assets it's very hard unless you have this form and it's free it's easily to fill out and we're gonna do it hopefully less than five minutes for you so the best way to do it is actually write in Adobe PDF if you just want something simple that's gonna say you're the owner and that you have any lawful and legal business but if it's going to be a little complicated then probably you want to download the Microsoft Word version so date we will just write in here and as you can see all you have to do is just write right in where the blanks are so party we will call it Appleseed muskets LLC in the state of we will call it Texas so as you can see it's just very generic the company name is Apple but did we have it up here Appleseed muskets LLC and the articles of organization from the company were filed with the Secretary of State the state of again Texas and we'll say it was filed on May 1st 2015 principal office address 1 2 3 Apple Bill Lane will states and Houston Texas 1 2 3 4 5 comma there see as you can see it's just very generic the company's initial designated office will be again you just write the 1 2 3 Apple Villa Houston and its initial agent for service this is the registered agent this is pretty person who'll be in charge of answering any notices on your behalf so you can write that address there and if the company's designated office within its agent for service of process may only be changed by filing those to change the secretary of state of Texas which the inter Google's the company were filed I'm just gotta breezing through this because it's just very generic name and address the sole member so this would be you the owner so you'd write your name and address Johnny Appleseed we will say 1 Hickory Road Houston Texas 1 2 3 4 6 so you can just keep going through as you can see this is just all very generic information that must be in the operating agreement so we're just going down till we see a blank again we got to enter the state again Texas on to the laws of Texas name of the number Johnny Appleseed you'll sign here and you'll want to have at least two witnesses and then at the very bottom this is actually very highly recommended is to actually have a notary you do your signature and it's what's called as being notarized because this is the best for legal authority and that is it that is how you can download a free single-member LLC operating agreement and fill it out

Thanks Wilber your participation is very much appreciated

- Olin Schnoor

About the author

Olin Schnoor

I've studied polymer chemistry at Kansas City Art Institute in Kansas City and I am an expert in string theory. I usually feel indifferent. My previous job was stained glass artist I held this position for 14 years, I love talking about deltiology (postcard collecting) and horse riding. Huge fan of Bethany Joy Lenz I practice boxing and collect beanie babies.

Try Not to laugh !

Joke resides here...

Tags

How do I set up an LLC in Oklahoma

How do I transfer ownership of an LLC in Oklahoma

How do I add a member to my LLC in Oklahoma

How much does an LLC cost in Missouri

How do I set up an LLC in Missouri

What taxes does an LLC pay in Missouri

Is law Depot legitimate

What is a LLC business

What are the advantages of the LLC form of Organization

Which one of the following should be contained in an operating agreement for an LLC

How do you write a simple operating agreement

Is articles of organization the same as operating agreement

Does Oklahoma require an operating agreement for LLC

Does Missouri require an operating agreement for an LLC

How do I create an operating agreement for an LLC

What should an operating agreement include

How is LLC ownership divided

How are profits divided in an LLC

Do LLC distributions have to be equal

: 6540

: 6540