Insurance for small business LLC in texas [Best Answer]

Table of Contents

- Does an LLC need insurance in Texas?

- How do I find out if a business is insured in Texas?

- Who is next insurance owned by?

- Is Texas car insurance expensive?

- What are the 4 basic insurance coverages that most businesses have?

- What are the three basic types of insurance for business?

- What happens if no business insurance?

- What happens if you get caught without business insurance?

- What happens if a business does not have insurance?

- Is business liability the same as general liability?

- Is it better to have full coverage or liability?

- How much is insurance for a small business in Texas?

- What is the difference between commercial general liability and general liability?

- Does Texas require small business insurance?

- What type of insurance is best for a small business?

- Do you need insurance to run a business?

- What is covered by general liability insurance?

- What does commercial general liability cover?

- How many employees do you have to have to offer insurance in Texas?

- Does Texas require commercial auto insurance?

Last updated : Sept 14, 2022

Written by : Elijah Hitchingham |

Current |

Write a comment |

Does an LLC need insurance in Texas?

Business insurance isn't required by law in Texas. In fact, Texas is the only state that doesn't require private employers to carry workers' compensation.

How much is insurance for a small business in Texas?

Professions that experience more injuries, such as construction trades, will typically pay more than desk jobs. Small business owners in Texas currently pay a median annual premium of $49 a month for business insurance, according to NEXT Insurance data.

Does Texas require small business insurance?

Texas Minimum Business Insurance Requirements Commercial General Liability insurance is not mandatory in Texas, but it protects business owners against claims of liability for bodily injury, property damage, and personal and advertising injury (slander).

What type of insurance is best for a small business?

- Employment practices liability insurance, also known as employers' liability insurance, helps protect your business from employment-related claims.

- A Business Owner's Policy (BOP) is one of the most popular types of insurance.

- Hazard Insurance.

- The quick answer is yes.

Do you need insurance to run a business?

The federal government requires every business with employees to have workers' compensation, unemployment, and disability insurance. Some states also require additional insurance. Laws requiring insurance vary by state, so visit your state's website to find out the requirements for your business.

What is covered by general liability insurance?

General liability insurance policies typically cover you and your company for claims involving bodily injuries and property damage resulting from your products, services or operations. It may also cover you if you are held liable for damages to your landlord's property.

What does commercial general liability cover?

Business Insurance A Commercial General Liability (CGL) policy protects your business from financial loss should you be liable for property damage or personal and advertising injury caused by your services, business operations or your employees.

How many employees do you have to have to offer insurance in Texas?

Note: Texas insurance law defines a small employer as a business with two to 50 employees, regardless of how many hours the employees work. If you provide health insurance, you must offer it to all your employees who work 30 hours or more each week. You must also offer coverage for their dependents.

Does Texas require commercial auto insurance?

Who needs commercial auto insurance in Texas? Any Texas company that uses vehicles for business purposes must have commercial vehicle insurance, whether it's the owner's personal vehicle or a fleet of vehicles owned by the business.

How do I find out if a business is insured in Texas?

Find out if the company is licensed to write policies in Texas by using Texas Department of Insurance Company Lookup or calling them at 1-800-252-3439.

Who is next insurance owned by?

there are three entrepreneurs who founded Next Insurance. They are Nissim Tapiro, Guy Goldstein, and Alon Huri. The trio had previously founded a company that they named Check, Inc. After establishing the company, it was purchased in 2014 by Intuit.

Is Texas car insurance expensive?

Texas' average car insurance cost is $1,316 per year. The Lone Star State features the 36th-most affordable average rates in the U.S., costing slightly less than the national average of $1,424.

What are the 4 basic insurance coverages that most businesses have?

- Property Insurance.

- Liability Insurance.

- Business Auto Insurance.

- Workers Compensation Insurance.

What are the three basic types of insurance for business?

It combines three essential coverages: General liability insurance. Commercial property insurance. Business income insurance.

What happens if no business insurance?

What happens if I don't have public liability insurance? Public liability insurance pays out to cover the costs of any claims against you – which means that if you don't have insurance, you'll have to pay all those costs yourself.

What happens if you get caught without business insurance?

Penalties for driving without insurance You could receive a fixed penalty of £300 and six penalty points on your licence if you are caught driving a vehicle that you are not insured to drive. If the case goes to court you could get an unlimited fine and be disqualified from driving.

What happens if a business does not have insurance?

In the event of an accident, the company will not only be prosecuted for having no insurance, it will remain liable to the injured party and have to pay all the compensation, its own legal costs and the claimant's costs out of its own funds. In many cases this would result in the company ceasing to trade.

Is business liability the same as general liability?

A business owner's policy (BOP) is essentially a general liability insurance policy with added property protectio. It bundles several insurance policies into a single package at a reduced rate.

Is it better to have full coverage or liability?

Liability and full coverage car insurance are different, but full coverage includes liability. Liability coverage protects you from the other driver's expenses should you cause an accident, while a full coverage policy also covers your own vehicle's damages, regardless of whether the damage is from a collision or not.

What is the difference between commercial general liability and general liability?

General liability insurance helps protect you from claims that your business caused bodily injury or property damage. It can also protect you if someone sues you for advertising injury. Commercial property insurance covers your business' physical location and equipment, whether you own or lease it.

Check these related keywords for more interesting articles :

Best state to setup a llc

Who does LLC near me living independent

What is the difference between LLC and llp corporations

How long does a LLC last for

How does an owner of an LLC get paid

Should i file LLC or scorp in pennsylvania

New york state annual LLC fee

Change llc name hawaii islands

How to start an LLC in maryland election

LLC converter vs phase shifted full bridge

Steps to starting an LLC in georgia

How to create an LLC company

LLC names that are taken into consideration

How to choose llc or corporation

Rental property LLC tax advantage

Did you find this article relevant to what you were looking for?

Write a comment

Comment by Diego Aningalan

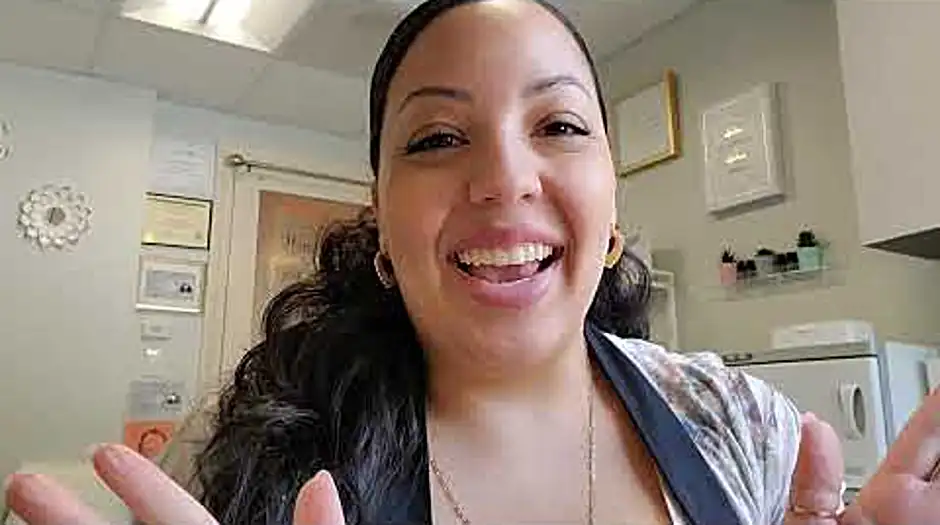

hi guys welcome back to my channel if you're new to my channel my name is melissa and i am a licensed esthetician i'm here to tell you guys a little bit about um receiving your llc and liability insurance so i'm going to be speaking on behalf of new york state so if you're located in another state you want to make sure to follow the guidelines and all of the qualifications that need to be met for your specific state and what i did so i can figure out how to get my llc and my liability insurance first to receive your llc you do want to make sure that you do have your licensure already to be an esthetician in your state you want to make sure you have taken both your state board practical and written exams that way you know everything can go smoothly the first thing i did to get started was i went to my.newyork.gov and that is basically the website that you go to if you want to start a business or you want to like update anything your licenses or anything like that you can find everything there and then you go you click i'm over here trying to remember because it's so long ago that i did it services and then you scroll down and you go to business and there is going to help you figure out step by step what you need to do so that you can actually start your business it'll give you like a checklist and that's basically what i use so that i can get through it because it's so much that you need to do and it's like very very very overwhelming so this checklist actually kept me on point and then i went to start a limited liability company llc you click on there it gives you an overview of everything that you that it talks about why you would want an llc what an llc stands for which is a limited liability company and what you know you you get to choose whether you want to be a sole proprietor or an llc and it's you know it tells you everything like all in detail about what an llc is it also tells you about the eligibility who is eligible to become an llc and the benefits of becoming an llc the llc cost about i believe it was like 200 for new york state um and so you know you do want to make sure that you have a name reserved um and you do want to pay for that i think it's like 20 or something like that it's super cheap but it's good to reserve your name so that you have your name and nobody else can take it while you're in the process of getting your your information and your business set up the llc is super quick i think it takes like a few days to process that's basically like the starter kit of getting an llc for me i had to get an llc and also articles of organization publication so i hired a publication service and it cost me about 350 to do that but they cover everything i don't have to worry about a thing and yeah that has to be done before i think 120 days after you have already filed for your articles of organization so yes liability insurance was super super easy for me the liability insurance i actually use is my ascp skin care i believe it's called i have it up there it's right up there asap um that was like 200 and something dollars for the year and i was introduced to it from my um aesthetic school so it was super easy and they had to say all the time i think it goes up to i don't know don't quote me just just go to the website asap let me just pull it up asap skincare.com and there you'll have all the information that you need that covers everything it covers education it covers um anything that may come up people trying to sue you uh any fire or any damage that gets that happens in the business everything is covered with a limited liability insurance um you also get the accessibility to a free website from the ascp skincare.com and you also get career toolkits and things that can help you like with marketing and stuff like that getting gift vouchers things that you can actually print out and keep keep inside your business advanced aesthetic insurance so if you're going for other classes and you actually do advance your own services in your business they do cover some other services as well so it's not just limited to one thing it covers a broad spectrum of things in the aesthetics business and you all know that aesthetics is a broad beauty business skincare beauty business so yes i hope this answers some of your questions and i'm so sorry that i'm looking over here but it's because it's been so long since i've done it that and when i was doing it i was so flustered um so yeah i hope this is super helpful i hope i answered your question and if you have any more questions please feel free to reach out to me i'm always willing to help all my future sd besties out there and i will see you guys next time bye

Thanks for your comment Diego Aningalan, have a nice day.

- Elijah Hitchingham, Staff Member

Comment by Elvin

workers come it's simple right by the insurance policy to cover you or your employees and move on with life right not exactly I'm Joseph with smut early insurance oftentimes a business owner or contractor may require a small workers compensation policy to meet the requirements of a hiring vendor such as a general contractor or a landlord for a retail or restaurant establishment or even an event venue that may require workers compensation of the food truck or event caterer that is on their premise although these policies can be simple to purchase providing the accurate amount of payroll and information is vital in the beginning of the policy so that you're not popped with a large audit at the end of the policy term our agency gets calls weekly regarding this scenario hopefully this animated scene will help you or someone you know understand the necessity of providing accurate payroll before purchasing a workers compensation policy check it out hello motherly insurance hey Joe this is Travis I need some workers comp insurance can you ho hey Travis of course we can help how many employees are working for you now well I don't really have employees I work with three subcontractors but I don't really think they need to be included I just need this for a job okay Travis I hear ya let me ask you this I know you said your subcontractors aren't really employees but do you make sure they have their own insurance oh I have no idea but I just need a workers comp policy for me right now can't you do that oh yeah of course we can but Travis understand if they don't have their own insurance you're responsible for their workers comp as well wait even though they're not on my payroll and they're not my employees yeah Travis I'm afraid that's right and get this the workers comp insurance company is legally required to perform an audit at the end of the year that means if we issue a worker's comp policy for only you and they learn later that all the subcontractors were not insured with their own insurance then the insurance company will charge you for covering all of them for the entire year what's more you may have to pay that fee in one large sum Hey look I'm not trying to make things difficult for you here Travis I just want to make sure we do this policy right so we're not burned with a large Fiat audit Tom our agency has seen way too many disgruntled customers that thought they were getting workers comp for cheap only to find that they had to pay a large fee for uninsured subcontractors in the end and I'd rather you not be one of those disgruntled customers know what I mean my friend Wow yeah that's valuable information thanks for educating me on this Joe it sounds like I need to have an insurance talk with my subcontractors before we before we put workers compensation in place I'll get back with you on this soon thanks again Joe I always appreciate you looking out for me

Thanks Elvin your participation is very much appreciated

- Elijah Hitchingham

About the author

Elijah Hitchingham

I've studied environmental geography at St. Cloud State University in St. Cloud and I am an expert in systematics. I usually feel lethargic. My previous job was contract administrator I held this position for 15 years, I love talking about karate and possession. Huge fan of Jeremy Bamber I practice rugby and collect cereal box prizes.

Try Not to laugh !

Joke resides here...

Tags

How do I find out if a business is insured in Texas

Who is next insurance owned by

Is Texas car insurance expensive

What are the 4 basic insurance coverages that most businesses have

What are the three basic types of insurance for business

What happens if no business insurance

What happens if you get caught without business insurance

What happens if a business does not have insurance

Is business liability the same as general liability

Is it better to have full coverage or liability

How much is insurance for a small business in Texas

What is the difference between commercial general liability and general liability

Does Texas require small business insurance

What type of insurance is best for a small business

Do you need insurance to run a business

What is covered by general liability insurance

What does commercial general liability cover

How many employees do you have to have to offer insurance in Texas

Does Texas require commercial auto insurance

: 7783

: 7783