Is LLC or c corp better homes [With Tuto]

Table of Contents

- What business entity is best for real estate?

- Why would you choose an C corporation?

- Should you flip houses under an LLC?

- What is the 70% rule in house flipping?

- What is the 2% rule in real estate?

- What is the most profitable type of rental property?

- What are the advantages of putting a rental property in an LLC?

- What is the most profitable thing to rent?

- What is not an advantage of C corp?

- What is tax rate for C corp?

- Do C Corp owners have to pay themselves salary?

- Why C Corp is better than S Corp?

- How often do C corps pay taxes?

- Which entity is best for flipping houses?

- What type of business is best for rental properties?

- What are the disadvantages of C corporation?

- How do C corp owners get paid?

- Can you switch from LLC to C corp?

- Who pays more taxes S corp or C corp?

- What are the disadvantages of an LLC?

Last updated : Sept 3, 2022

Written by : Rusty Tresch |

Current |

Write a comment |

What business entity is best for real estate?

The Limited Liability Company (known as LLC) is the best entity for most real estate and mortgage investors who "buy and hold" their investments. When you buy and hold real estate it is considered a capital asset.

Why C Corp is better than S Corp?

C corps are better for businesses that: Have foreign connections: Unlike S corps, C corps have no limits on foreign ownership. Reinvest profits: C corps let you build wealth in your business without drawing it down as personal income. Need unlimited growth potential: C corporations can issue unlimited shares of stock.

Which entity is best for flipping houses?

Limited Liability Company (LLC) Generally, LLCs are often regarded as the best entity for flipping houses, and they are the most recommended choice when structuring a company holding real estate, as they are more flexible for tax purposes.

What type of business is best for rental properties?

A limited liability company (LLC) is an ideal business structure for rental property owners. Since real estate investing involves plenty of capital (i.e., the property) and unique risks, an LLC crucially separates your private and business dealings.

What are the disadvantages of C corporation?

- Double taxation. It's inevitable as revenue is taxed at the company level and again as shareholder dividends.

- Expensive to start. There are a lot of fees that come with filing the Articles of Incorporation.

- Regulations and formalities.

- No deduction of corporate losses.

How do C corp owners get paid?

There is generally one way to pay yourself from your C corp: as an employee. More specifically, if you're involved in the day-to-day operations of running your C corp, then you're considered a W-2 employee. Therefore, you will receive compensation via a W-2 that will also be subject to payroll taxes.

Can you switch from LLC to C corp?

Most states allow LLCs to be converted to a corporation by the simple filing of documents with the state. At the time of the conversion the LLC by operation of law becomes a corporation and, therefore, the owner of all the assets, liabilities and obligations of the LLC.

Who pays more taxes S corp or C corp?

If your company is making a profit and you want to take some of that money out of the company, it's generally cheaper to do so as an S corp than a C corp. But note that in some cases, the personal income tax rate paid by S corp shareholders will be higher than the corporate income tax rate.

What are the disadvantages of an LLC?

- Cost: An LLC usually costs more to form and maintain than a sole proprietorship or general partnership. States charge an initial formation fee.

- Transferable ownership. Ownership in an LLC is often harder to transfer than with a corporation.

Why would you choose an C corporation?

Why choose a c corporation? C corporations provide limited liability protection to owners, who are called shareholders, meaning owners are typically not personally responsible for business debts and liabilities.

Should you flip houses under an LLC?

Yes. An LLC will give you personal liability protection against potential business risks as well as give your house flipping business more tax options and credibility. It is relatively inexpensive and simple to form and maintain an LLC. Learn more about house flipping LLC benefits.

What is the 70% rule in house flipping?

The 70% rule helps home flippers determine the maximum price they should pay for an investment property. Basically, they should spend no more than 70% of the home's after-repair value minus the costs of renovating the property.

What is the 2% rule in real estate?

The 2% rule states that the monthly rent for an investment property should be equal to or no less than 2% of the purchase price. Here's an example of the 2% rule for a home with the purchase price of $150,000: $150,000 x 0.02 = $3,000.

What is the most profitable type of rental property?

But what type of real estate is the most profitable for 2022? The answer is quite simple- Investing in rental properties is the best investment for 2022. To be more specific, the best types of real estate investment are traditional and Airbnb rental properties.

What are the advantages of putting a rental property in an LLC?

The biggest benefit of creating an LLC for your rental property is that it can insulate you from personal liability. Yes, you may have liability insurance, but if someone is seriously injured on your property, they can sue you personally for medical expenses and damages above and beyond the limits of your policy.

What is the most profitable thing to rent?

- Party rental business.

- Wedding & event rentals.

- Camera & lens rentals.

- Bike rental store.

- E-bike rentals.

- Ski & snowboard rentals.

- Baby equipment rentals.

- Canoe & kayak rentals.

What is not an advantage of C corp?

Disadvantages of C Corporation One of the primary disadvantages of the C corporation is double taxation. With this type of business entity, you have to pay taxes at the corporate level, and then once the profits are distributed to shareholders, they must pay taxes on the money they receive as well.

What is tax rate for C corp?

A C-corp simply applies the corporate tax rate of 21% to its taxable income.

Do C Corp owners have to pay themselves salary?

If your business is classified as a C Corp, you are legally obligated to pay yourself a salary as a W-2 employee with the appropriate taxes taken out. This is because C corps are owned by shareholders, which means its earnings are essentially “owned†by the company.

How often do C corps pay taxes?

Generally, a C corporation pays taxes annually, on their earnings, under the guidelines of the Internal Revenue Code , unless it decides to be taxed as an S corporation . We tax the shareholders of a C corporation separately from the business.

Check these related keywords for more interesting articles :

How much does it cost to publish an llc in nys

Business bank account for llc online

Irs LLC types explained

LLC in florida rules of evidence

What is a purpose clause for LLC

How much does an llc cost in new jersey

How to register as a LLC in nc

Where can i create an LLC

Do you need insurance as an llc

Difference in dba and llc

Apply llc michigan online

LLC articles of organization oklahoma

Dole holding company llc

Delaware llc annual tax payment

How to make llc in alabama

Did you find this article relevant to what you were looking for?

Write a comment

Comment by Mallie Trayer

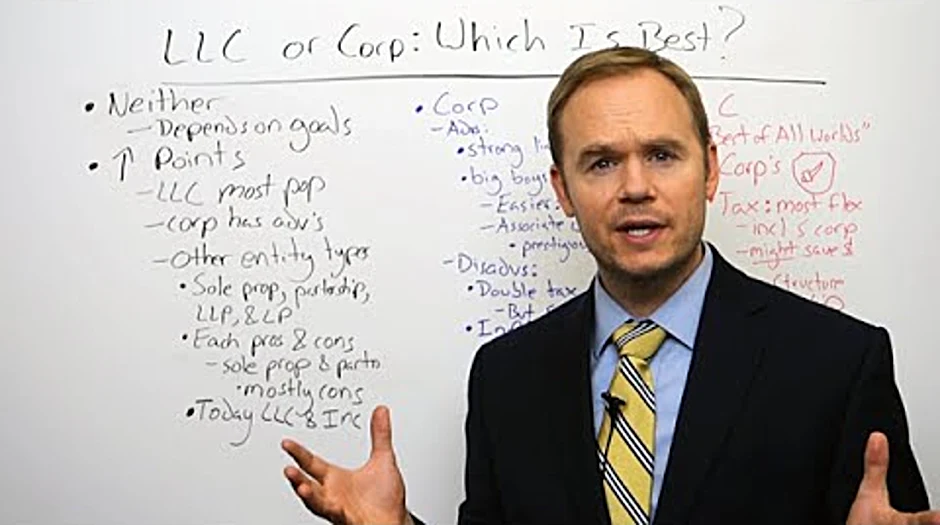

hello and welcome to an edition of Genesis Law Firm teaches today's topic is this one LLC or corporation which is better this is a very frequently asked question should I form an LLC a limited liability company or should I form a corporation for my new business the answer is that neither is necessarily the better option it depends upon you and what you want to accomplish with your business in this video we're going to go through the high points of this discussion which is better an LLC or a corporation LLC's are the most popular and any choice available including when compared to corporations but corporations do have their advantages by the way there are many other entity types out there you could be a sole proprietor a partner you could be a limited liability partnership a limited partnership and all of these entity types have their pros and their cons by the way if you form a sole proprietorship or a partnership there are probably more cons than pros usually you won't want to choose those two options you'll want one of these other options that I mentioned a limited liability entity like a corporation or LLC in today's video we're going to focus exclusively on LLC's in corporations because they are the most popular two entity types let's first look at corporations and their advantages corporations have a very strong liability shield for their owners in fact this is the reason why there are so many corporations out there when corporations first came into existence it was the only way that you could create an entity shield of this type so if you've really wanted to protect the individuals assets and only expose whatever might have been invested in the business then you would have chosen a corporation it's also what the big boys use if you want to be like a Microsoft or a Boeing and go public then you'll want to be a corporation similarly if you want to associate with the big boys if you want people to think that you're big even though perhaps you might not be if you want that kind of prestige then maybe you would form a corporation rather than an LLC disadvantages as I mentioned there are some drawbacks here one of the biggest is that if you form a corporation the way the big boys do you subject yourself to double taxation there's taxation both at the corporate level and at the individual level so most people won't want to form a business exactly like Microsoft or Boeing instead people who form corporations will at least initially choose to be taxed under the S corporation election and that means there's only one level of Taxation but you can only do this while the corporation is closely held and there are certain other restrictions the I think biggest reason why people might choose not to form a corporation would be the inflexibility of the corporate structure you're almost always going to have I shouldn't say almost always you're always going to have a board and executives and that can be a cumbersome way to do business most people would prefer to do business either in a way that's similar to a sole proprietorship or a partnership because of the ease and how the decisions are made next let's look at LLC's limited liability companies some people say that LLC's are the best of all worlds and I can't say that that's necessarily true but there are many advantages one of the big advantages is that you get a corporation's liability shield you get the same protection for the owners that a corporation provides that's unique among all the other entities out there so these are the two best in terms of their entity shields with an LLC you get the most flexibility in terms of how you choose to be taxed even more flexibility than with a corporation so if you're trying to save money tax wise and LLC might be a good choice but ultimately most businesses end up being taxed as S corporations regardless of whether they're a corporation or an LLC because they both make the same tax election so it may not be that there's a big tax savings by choosing to form an LLC versus a corporation but you might save some money the really big reason for forming an LLC would be the flexibility of the entity structure you can choose to structure this business almost any way you want including running it as a partnership which is what most people who have multiple owners of the business really want to do the biggest disadvantage of an LLC is that it's not what the big boys use if you intend to go public or you want to associate yourself with that kind of big business then perhaps an LLC is not the best choice for you bottom line an LLC is going to be better for most people and their businesses but you might choose to form a corporation instead if you want to go public maybe you're not ready to do it now but you intend to do it in the future or if you want to associate yourself with those big dogs and I should mention that you can form an LLC and convert it to a corporation at a later date so that might be how you would truly get the best of all worlds if you would like more information on this topic or related topics you can go to our website and you might want to click on the resources tab that's where most of our videos and articles are and if you would like the address for the article associated with the same topic that we're discussing today you can find it here

Thanks for your comment Mallie Trayer, have a nice day.

- Rusty Tresch, Staff Member

Comment by encuberte2

are you considering if your business should be a llc or a c corporation do you know the difference between the two well stay tuned because this video will take a deep dive into the differences and similarities between an llc and a c corporation and also i'll be discussing which might be the best option for your business i'm crystal cpa and co-founder of life accounting where we like to teach and empower small business owners to take complete control of their financial picture today i will be discussing the key differences and similarities between an llc and a c corporation especially the tax differences and what you could expect to pay in taxes with each type i'll also explain the compliance requirements of each and how you can decide which is best for your small business now to be fully transparent here i'm not a lawyer and by no means am i giving you legal or financial advice but i am a licensed cpa and i will break down the gist of the legal jargon and especially focus on the tax items so you can avoid paying too much in taxes and as we all know or should know how you decide to structure your business significantly impacts the amount of taxes you pay after all taxes are your biggest expense all of which and more i'm going to explain to you in this video make sure to subscribe to our channel if you're new we publish videos almost every single day and i'm confident that one some or all of them will help you navigate accounting and tax in your life all right let's dive in one of the biggest differences between an llc and a c corporation is taxation this is probably the single most important difference to understand and you should be aware of it c corporations experience double taxation double taxation means the c corporation as an entity pays taxes on its income and when you the shareholder of the c corporation takes money out in the form of the dividend or distribution you are also taxed personally so with a c corporation you are paying taxes twice on the same income did you catch that the income is first taxed through the business with corporate income taxes this income already includes the distributions or dividends that you took out of the business then it's taxed again on your personal return for any amount you took out of the business in the form of a dividend or distribution the current corporate tax rate is 21 and the federal deadline to file and pay these taxes is april 15th on form 1120 and the individual tax rate on corporate income would depend on your personal tax rate and consider all of your income from all sources on the other hand llcs only pay tax on the individual level as a default meaning the llc entity does not pay taxes directly unlike in a c-corporation situation but the income earned through the llc is passed to the owner where taxes are assessed this is called pass-through taxation most llcs are single members so those tax returns are due april 15th for multi-member llcs or s corp llcs those tax returns are due on march 15th however as an llc owner you can actually decide how you want your llc to be taxed so you can be taxed as a sole proprietor an s corporation and even a c corporation so as you can tell an llc offers you more flexibility in taxation whereas with a c corporation not so much you're going to be double taxed another difference is how llcs and c-corporations are formed there's a lot more administrative work with forming a corporation first corporations are required to have articles of incorporation which is simply a set of documents that are filed with the state to legally document the formation of the corporation second there's the corporate bylaws which are a set of rules and regulations adopted by the corporation third you have to elect a board of directors the board of directors represent the shareholders of the corporation fourth you have to hold a board meeting which is a formal meeting with the board of directors to discuss performance and other major issues in the corporation fifth you also have to hold a shareholders meeting which is a formal meeting with the shareholders of the company to vote on specific issues and review finances both board and shareholder meetings are required to occur at least once a year and details of those meetings must be kept in the meeting minutes in order to maintain corporate status sixth and finally you have to issue stock and shares in the company based on what was invested as capital in the corporation that's a lot most corporations seek the help of an attorney to form their corporation forming an llc is much simpler first you need to have your articles of organization this is a similar document to the articles of incorporation for c-corporations next you should have an operating agreement similar to the by-laws which outlines how your llc will operate it's important to note that both the operating agreement and bylaws and even the articles of incorporation and organization are legally binding documents it is very important to understand what is being included in these documents because they could come back and bind you later on the last difference i want to touch on is the ownership of each a corporation can issue shares of stocks and sell percentages of the business to its owners or shareholders these shareholders can then buy or sell their shares for more or less ownership in the company a corporation also exists in perpetuity separate from its shareholders meaning that a corporation remains in existence even when a shareholder leaves the company an llc has the freedom to distribute its ownership stake to its members without regard to a member's financial contribution to the llc for example a member of an llc may not have invested as much capital as another member however an llc's operating agreement could specify that all members receive an equal share of the profits anyway this creates more flexibility when establishing the ownership of the llc all right so we've talked a lot about the differences between an llc and a c corporation but what about the similarities well for one both llc's and c corporations offer its owners limited liability for llcs this is literally a part of its name limited liability company but what this means is the owners of the llc or corporation are not personally liable for the company's debts or liabilities so basically if someone sues your llc or corporation they cannot go after your personal assets like your house or personal funds another similarity is that llcs and corporations can both be owned by u.s and non-us individuals which is not the case for s-corporations llcs and corporations also allow you to have unlimited owners which could be helpful if you're planning on starting the next fortune 500 company which actually brings me to my next point which one is right for your business again i'm just a cpa so i can only really speak from that perspective but for most business owners llcs tend to be the better choice llcs are the definition of flexibility they give you the choice of how you want your partner's ownership percentages to be allocated not to mention you can choose how you want to be taxed so if for some rea

Thanks encuberte2 your participation is very much appreciated

- Rusty Tresch

About the author

Rusty Tresch

I've studied finnish history at Wingate University in Wingate and I am an expert in demography. I usually feel gloomy. My previous job was fish & game warden I held this position for 4 years, I love talking about rail transport modelling and learning. Huge fan of Dale Earnhardt I practice swimming and collect autographed baseballs.

Try Not to laugh !

Joke resides here...

Tags

Why would you choose an C corporation

Should you flip houses under an LLC

What is the 70 rule in house flipping

What is the 2 rule in real estate

What is the most profitable type of rental property

What are the advantages of putting a rental property in an LLC

What is the most profitable thing to rent

What is not an advantage of C corp

What is tax rate for C corp

Do C Corp owners have to pay themselves salary

Why C Corp is better than S Corp

How often do C corps pay taxes

Which entity is best for flipping houses

What type of business is best for rental properties

What are the disadvantages of C corporation

How do C corp owners get paid

Can you switch from LLC to C corp

Who pays more taxes S corp or C corp

What are the disadvantages of an LLC

: 2422

: 2422