Is the owner of an LLC public record [Deep Research]

Table of Contents

- Can you hide the owner of an LLC?

- What shows proof of ownership?

- Are Delaware LLC Agreements public record?

- How do I find out who owns a LLC in Wyoming?

- How do you find out who owns a Wyoming LLC?

- What information is public on Wyoming LLC?

- Does it matter whose name is on the LLC?

- How do I protect myself from an LLC?

- Can I hide my money in an LLC?

- What is the difference between LLC and owner?

- Is the manager of an LLC the owner?

- How do I find the owner of a business?

- What is the highest position in an LLC?

- How do I prove ownership of an LLC in Delaware?

- Is Wyoming LLC anonymous?

- How do you hide identity in an LLC?

- What does an owner of an LLC call himself?

- Who is the business owner of a company?

- How do I find out how much a business owner makes?

- What shows ownership in an LLC?

Last updated : Sept 27, 2022

Written by : Columbus Shamel |

Current |

Write a comment |

Can you hide the owner of an LLC?

An anonymous limited liability company is one that hides all ownership information. This is accomplished by creating an anonymous LLC in a state that allows it and then using a different person to register it. The secrecy jurisdiction keeps company information anonymous.

How do I find the owner of a business?

- Search State Databases. LLCs submit articles of organization and other public filings with the state's Secretary of State office or a comparable state agency.

- Submit a Public Information Request.

- Check the Company Website.

- Dig into Alternative Public Records.

How do I prove ownership of an LLC in Delaware?

The Delaware LLC is governed by a contract among all the members called the "operating agreement," which all members must sign. As a member, you should have a copy of the agreement, which you can then present to a bank or other official to verify that you are a member of the LLC.

Is Wyoming LLC anonymous?

A Wyoming LLC is anonymous if you want it to be. Wyoming does not require members or managers be listed, only the registered agent and person who files the paperwork. Every WY LLC we file is private. Creating an anonymous LLC in Wyoming is as simple as finding a registered agent willing to act as the organizer.

How do you hide identity in an LLC?

- Set up a series of companies. This is the most typical way of protecting your privacy.

- Create a blind trust, naming yourself as the beneficiary.

- Set up business documents with a business address, such as a low-cost mailbox.

- Address payment records somehow.

What does an owner of an LLC call himself?

If you own all or part of an LLC, you are known as a “member.†LLCs can have one member or many members. In some LLCs, the business is operated, or “managed†by its members. In other LLCs, there are at least some members who are not actively involved in running the business.

Who is the business owner of a company?

A business owner is one person who is in control of the operational and monetary aspects of a business. Any entity that produces and sells goods and services for profit, such as an ecommerce store or freelance writer, is considered a business. Businesses can be run alone or with a group of people.

How do I find out how much a business owner makes?

- Profitability of the Company. You can't pay yourself, or any employee, money that isn't available.

- Compare Your Salary to Others.

- Pay Your Debts Comfortably.

- Determine Your Salary Proportionally.

What shows ownership in an LLC?

Your EIN confirmation letter does show LLC ownership. This is a document sent directly from the IRS (Internal Revenue Service). It will show your EIN, LLC name and the member of the LLC who is the authorized responsible member!

What shows proof of ownership?

To officially prove ownership of a property, you will require Official Copies of the register and title plan; these are what people commonly refer to as title deeds because they are the irrefutable proof of ownership of a property.

Are Delaware LLC Agreements public record?

For Delaware LLCs formed and maintained through Harvard Business Services, Inc., the state of Delaware's public record will, therefore, contain no information about your LLC's members and/or managers. 100% of your Delaware LLC is not on the public record.

How do I find out who owns a LLC in Wyoming?

In Wyoming, search for a business entity (Corporation, LLC, Limited Partnership) by using the Secretary of State's Website. Lookup by Name or Filing ID Number. When using the Name option, be sure to use as many matching terms you can as the database will pull all related listings.

How do you find out who owns a Wyoming LLC?

We commonly use the Wyoming Secretary of State's website to search for business filings. Their online portal allows you to see what company names are available, what filings have been accepted and provides a snapshot of each company's corporate history. Every company document can be searched, viewed and downloaded.

What information is public on Wyoming LLC?

How we can help with privacy on Wyoming LLC's. If you file a company on your own, you must list the incorporator's name and address on the initial paperwork filed with the State. That information is available to the public. This is one of the main reasons that people choose to utilize our services.

Does it matter whose name is on the LLC?

Yes, with some exceptions. When you're forming a corporation or an LLC in a state, the name must be unique to your business within that state. Others can form LLCs and businesses in other states that have the same name as yours.

How do I protect myself from an LLC?

- Run Your LLC as an Independent Entity.

- Buy Appropriate Levels of Insurance.

- Elect Corporate Status for Your LLC.

- Explore Trusts Options to Protect Assets.

Can I hide my money in an LLC?

For those of you who would like another way, other than a trust to hide assets from creditors legally, consider forming an LLC or corporation. The LLC, for instance, can protect the entity, assets and the owner. You also have the option to anonymously contribute to the assets of your LLC.

What is the difference between LLC and owner?

An LLC exists separately from its owners—known as members. However, members are not personally responsible for business debts and liabilities. Instead, the LLC is responsible. A sole proprietorship is an unincorporated business owned and run by one person.

Is the manager of an LLC the owner?

A limited liability company (LLC) managing member is both an LLC owner and someone who keeps the business running on a day-to-day basis. The managerial aspect generally includes having the authority to make decisions and enter into contracts on behalf of the business.

What is the highest position in an LLC?

President is the most popular title for the highest ranking manager in an LLC. The LLC Operating Agreement typically gives the President general management powers over the business. This includes the ability to open bank accounts for the LLC.

Check these related keywords for more interesting articles :

How to open an LLC texas

Does an llc end when the owner dies

Illinois LLC name lookup

Are llc pass through taxation new tax plan

Can you sue a llc company

How to find owner of llc in wisconsin

Ca llc filing fee due date

Sunbiz florida LLC registration search

What is a voip number serviced by onvoy LLC

What should your LLC name bella

Who owns am general LLC news

How to register foreign LLC in illinois

How to file llc for free

How to create llc in new york

Free article of organization llc template

Did you find this article relevant to what you were looking for?

Write a comment

Comment by Kaitlin Farnese

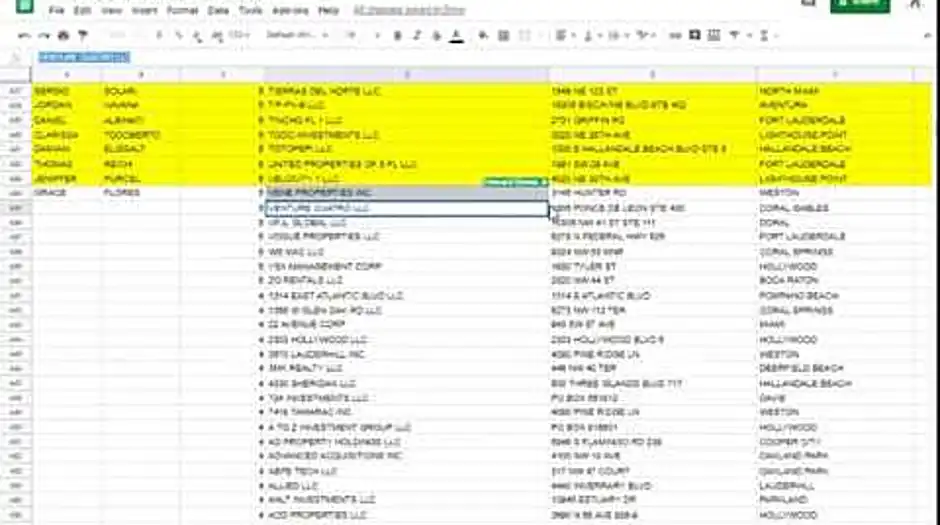

hey in this video I want to show you how to find the owners of an LLC I'm just in case you're wondering like you get a property you see the property is owned by an LLC you don't know who the owner is I'll show you exactly how the file find the owner or the president of that LLC and their address so first thing we will do is um I'm going to go to google.com and just open a spreadsheet yes oh this file is called Brower cash buyers cash by your holders these are people that are landlords they own properties and they're just holding on to them as you can see this property right here this company right here SRP sub LLC they own 918 properties currently right now and I scrubbed these already the owner's name is energy associate this is address I'm going to show you how to find the owner of the LLC even when you don't um even when you don't have the owner's name in front of you so this is where I left off on line 434 as you can see I don't have the owner's names yet so what I'm going to do is take the name of this corporation or this um yeah this corporation or LLC I'll copy it I'm gonna go to a website call sunbeds org again son biz org here in Florida it'll give you the names of all the corporations or LLC's in the state of Florida so I'm going to come here to this line and just paste the name of the company here then properties inc as you can see I found it here make sure it's active because that's going to be the right one sometimes these people they are enclose the old company and I'll start a new one if it says inactive that means it's it's no longer no longer active so they show the carpet do you have the right file the one that's active so then properties inc I'm gonna click on the name and I scroll down so you're gonna see the registered agent don't use that name because this could be an attorney that registered the company for them you don't trust that sometimes it will be the owner would don't look there and come down to the bottom where it says officers or directors and you'll look for the name here like right here you can see grace Flores title President Jose title vice president who's the owner like who should I mail should I mail grace or should I call grace or Jose let's go down to their annual reports I'm gonna flick on the first annual report and usually the person that's really in charge they'll sign the form so as you can see right here grace Flores she signed here's her signature her electronic signature so yeah I'm gonna go with grace Flores as the owner because she signed it here's her address here's her house address as you can see on the Sun beers website there's a different address watch this up here her dresses 31:45 hunter rural western Florida but over here it's leeward way well let's see and this could be an old adjust right here because this was signed back in 2014 and this one could be the new address so what we have to do is is do a little bit of research I'm gonna copy this address I'm gonna put that into Google and I'm gonna see what type of pictures come back it looks like it could be a house look on Zillow see if they have any good pictures yes five bedrooms six bathrooms 7,000 square feet so that is a house I'm gonna use that address the hunter Road address Westin if it was an office address I will use the old address this one here leeward wait but since it is a house I'm gonna go ahead and use this one then the newer one the one that's on file for 2017 I'll just take the name on grace Flores put it on my spreadsheet grace is our first name flourishes our last name make sure that just matches how to roll and I'll go to the next file I skip this one so I'm gonna go back to it I'll do one more and I'm sure you'll get the picture velocity city one LLC I'll copy that I'll go back to sunbeds board all right here I'll paste it it off search velocity one LLC it is active so I'm going to use this one right here velocity one I remember don't use the registered agents name because this could be an attorney so I'm going to come down here where's this authorized person's title ambassador title ambassador right here I have Jennifer Purcell Lighthouse Point if you wanted to you can come down here and check their annual report see if she signs off on it if so most likely she's the owner or the president he again she saw Jennifer Purcell Lighthouse Point so I'm gonna use that name Jennifer personnel don't you can see the gesture they have for her somewhere in Newport City and it looks like a sweet so that's gonna be our office sometimes when i doing skiptrace the office address it won't it won't come back so I'm going to use on this physical just that I have for her lighthouse point I think I can get a phone number from this before I can get a phone number from her office address yes I'll just copy and paste her address in here you don't have to you can do it yourself you could type it but for this video I'm just gonna copy and paste and that's pretty much it you just keep doing the same thing over and over just goes to the next name copy that paste it into some biz or venture cultural LLC the intercultural Elsi make sure it's active slow down don't use the registered name agents name use the authorized person give run Garcia or this person right here I'm not sure who owns the company again come down to the annual report see who's side give her inside it's most likely um he's the owner but it also says he's an attorney right here most likely he's the owner we wanted to use him you could wanted to use the other person you could we just want to get a phone number so we can contact these people you have the same address so yeah that's it man just keep scrubbing on your list just many names phone numbers as you there's many names as you can so we can skip trace get the phone numbers give them a call and see if they want to be a part of your buyers list have any questions feel free to reach out to me or your team leader good luck have a blessed day

Thanks for your comment Kaitlin Farnese, have a nice day.

- Columbus Shamel, Staff Member

Comment by jesticles9

hi Ellie Phillips here I want to talk today about who owns a limited liability company who owns an LLC and it's a question that I get quite often and it's kind of a whoop duh the owners on the LLC yeah that's true but who are the owners and now I'll see we don't call them owners we don't call them shareholders like we do in a corporation we call them members they're members they're not partners they're our members and those are the guys who own it so who can own the LLC maybe that's a better question the fact of the matter is is it depends upon how the LLC is taxed as to who can own it if it's a single owner taxed as a disregarded entity or a sole proprietorship then you are going to own it now wait wait wait wait maybe we don't want you to own it maybe we want your living revocable trust to own it because if your living revocable trust owns it then your family doesn't have to probate it when you die so in the back of your mind and I'm gonna go fast think when I say you own it no no youyou don't actually own it you're living revocable trust owns it but for practical purposes for legal purposes for tax purposes you are your living revocable trust so if it's one guy one living revocable trust you then you have it taxed as a sole proprietorship and then if you're going to tax it as a partnership you can basically have anybody you want own a partnership interest be a member if it's taxed under subchapter S you've got to follow the subchapter S rules as do owns it the short story is is that subchapter S requires basically that a warm-blooded America citizen owns it now we can get green card holders and we can get a bunch of things but you can't have another LLC or a corporation or another entity owned an interest in an LLC or corporation that's taxed under subchapter S of the IRS code there are very specific rules you can only have a limited number when I started out I think was like 20 yeah sure yeah I think it's more like 150 now that tells you how old I am yes and my phone is on I apologize you've got the hundred and fifty that or whatever it is today that a subchapter S entity can actually have as the owners and they have to be people because the IRS wants to make sure that they can find that person and get that person taxed as an owner or a member of the LLC if it's a taxon under Chapter C of the IRS code that's the same as the C corporation that's the same as IBM Ford all the rest of these guys and you can have as many members or owners as you want you can sell stock on the stock exchange if you register it and do all that stuff so who is the owner of an LLC depends upon how the LLC is taxed generally your gonna be the owner actually you're not your living revocable trust is and that's the way the vast majority of LLC's are set up by the way one one more thing I said that if it's taxed under subchapter S and you may want your little LLC taxed under subchapter S if you are earning earned income you're selling goods or services basically then you want it taxed problem under subchapter S there's some big tax advantages and we talk about those in other videos that we have but can your living revocable trust own the membership interest if it's taxed under subchapter S I just told you that I had to be a warm blooded American citizen and then I told you earlier that you're living a revocable trust for legal and everything else is you so can your trust on the stock the membership interests in the LLC that's taxed under subchapter S the answer is yes if it meets what week if it's a qualified subchapter S trust and it has to meet I think seven criteria basically you have to get all the income from it and it has to be paid out at least annually so if your trust is properly written and meets these criteria then your trust can even own your membership interest in an LLC taxed under subchapter S Lee Phillips talking about who owns an LLC who owns a limited liability company

Thanks jesticles9 your participation is very much appreciated

- Columbus Shamel

About the author

Columbus Shamel

I've studied solid geometry at George Fox University in Newberg and I am an expert in military policy. I usually feel calm. My previous job was fence installer I held this position for 14 years, I love talking about footbag and bushcraft. Huge fan of MrBeast I practice skydiving and collect phone cards.

Try Not to laugh !

Joke resides here...

Tags

What shows proof of ownership

Are Delaware LLC Agreements public record

How do I find out who owns a LLC in Wyoming

How do you find out who owns a Wyoming LLC

What information is public on Wyoming LLC

Does it matter whose name is on the LLC

How do I protect myself from an LLC

Can I hide my money in an LLC

What is the difference between LLC and owner

Is the manager of an LLC the owner

How do I find the owner of a business

What is the highest position in an LLC

How do I prove ownership of an LLC in Delaware

Is Wyoming LLC anonymous

How do you hide identity in an LLC

What does an owner of an LLC call himself

Who is the business owner of a company

How do I find out how much a business owner makes

What shows ownership in an LLC

: 9414

: 9414