LLC fee california instructions 568 form [Real Research]

Table of Contents

- How much does it cost to file Form 568?

- How do I fill out form 568 in California?

- Can you file form 568 online?

- What happens if you don't file 568?

- Who must file California Form 568?

- What is Form 568 used for?

- Does a single-member LLC need to pay California Franchise Tax?

- What is the difference between CA Form 565 and 568?

- How do I pay the $800 franchise tax?

- What is the difference between single-member LLC and multi member LLC?

- Can I file my LLC and personal taxes separate?

- Can you deduct LLC fee on California return?

- How do I file taxes for my LLC?

- How do I pay my annual LLC fee in California?

- Does a single member LLC need to file Form 568 in California?

- Does a single member LLC need to file form 568?

- Can I file 568 with TurboTax?

- Do you have to pay the $800 California LLC fee every year?

- Is CA LLC fee waived first year?

- Is California LLC tax deductible for California?

Last updated : Sept 5, 2022

Written by : Lasonya Norgard |

Current |

Write a comment |

How much does it cost to file Form 568?

Although California law uses the same entity classification as federal, LLCs classified as partnerships and disregarded LLCs must do all of the following: File Form 568. Pay an annual tax of $800 (refer to Annual Tax Section); and.

Can you deduct LLC fee on California return?

Every year after that, the tax payments are due on the 15th of the fourth month of your tax year — April 15 for most businesses. Plus, California's LLC annual fee is tax deductible for federal taxes. You can deduct the $800 Franchise Tax – and any additional annual fee you pay.

How do I pay my annual LLC fee in California?

You can pay the $800 annual tax with Limited Liability Company Tax Voucher (FTB 3522) by the 15th day of the 4th month after the beginning of the current tax year. You can estimate and pay the LLC fee with Estimated Fee for LLCs (FTB 3536) by the 15th day of the 6th month after the beginning of the current tax year.

Does a single member LLC need to file Form 568 in California?

Generally, a disregarded SMLLC that is owned by an individual or a non-pass through entity must file a Form 568 by the 15th day of the fourth month after the close of the taxable year of the owner except if the disregarded SMLLC is owned by a pass-through entity, then the Form 568 must be filed by the 15th day of the ...

Does a single member LLC need to file form 568?

If your LLC has one owner, you're a single member limited liability company (SMLLC). If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC. We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes.

Can I file 568 with TurboTax?

Can I file 568 with TurboTax? Yes, you can use TurboTax Home & Business for Tax year 2020 to file Form 568 along with your personal Federal and State income tax returns. In 2020, you will be able to electronically file your Form 568 when you file your personal income tax return as long as you only have one Form 568.

Do you have to pay the $800 California LLC fee every year?

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

Is CA LLC fee waived first year?

A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year. Business entities such as LLCs, LLPs, and LPs are subject to an $800 annual tax.

Is California LLC tax deductible for California?

Is the California LLC Tax ($800) and/or LLC Fee ($900+) Deductible on Personal Return (SMLLC disregarded)? According to information available on the Internal Revenue Service's website, the answer is yes.

How do I fill out form 568 in California?

- Line 1—Total income from Schedule IW. Enter the total income.

- Line 2—Limited liability company fee. Enter the amount of the LLC fee. The LLC must pay a fee if the total California income is equal to or greater than $250,000.

Can you file form 568 online?

Yes, California Form 568, Limited Liability Company Return of Income may be e-filed.

What happens if you don't file 568?

If an LLC fails to file the form on time, they will need to pay a late fee. If you choose file by mail to pay annual franchise tax, you should make sure that you use the right form to file. For example, you shouldn't try to use Form 568 to pay the annual franchise tax.

Who must file California Form 568?

Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. The LLC is organized in California. The LLC is organized in another state or foreign country, but registered with the California SOS.

What is Form 568 used for?

Purpose. Use Form 568 to: Determine the amount of the LLC fee (including a disregarded entity's fee) based on total California income. Report the LLC fee.

Does a single-member LLC need to pay California Franchise Tax?

California Single-Member LLC Taxation The California Franchise Tax Board states that a single-member LLC will be treated as a disregarded entity, unless it elects to be taxed as a corporation. Every single-member LLC must pay the $800 Franchise Tax fee each year to the Franchise Tax Board.

What is the difference between CA Form 565 and 568?

You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

How do I pay the $800 franchise tax?

The state requires corporations to pay either $800 or the corporation's net income multiplied by its applicable corporate tax rate, whichever is larger. You may pay the tax online, by mail, or in person at the California Franchise Tax Board Field Offices.

What is the difference between single-member LLC and multi member LLC?

Single-member LLC Ownership – A Single-member LLC has one owner (member) who has full control over the company. The LLC is its own legal entity, independent of its owner. Multi-member LLC Ownership – A Multi-member LLC has two or more owners (members) that share control of the company.

Can I file my LLC and personal taxes separate?

The IRS disregards the LLC entity as being separate and distinct from the owner. Essentially, this means that the LLC typically files the business tax information with your personal tax returns on Schedule C. The profit or loss from your businesses is included with the other income your report on Form 1040.

How do I file taxes for my LLC?

If the LLC is a corporation, normal corporate tax rules will apply to the LLC and it should file a Form 1120, U.S. Corporation Income Tax Return. The 1120 is the C corporation income tax return, and there are no flow-through items to a 1040 or 1040-SR from a C corporation return.

Check these related keywords for more interesting articles :

How to find out who owns a llc in texas

A12 standard 230v eu ssr600ra llc vs corporation

Should an online boutique be an LLC

What are the benefits of an LLC in florida

LLC in texas annual fee

LLC s corp 1099 reporting

Amazon services llc reviews

Free llc registration wi

How to use your LLC to save taxes tricks

Where do i go to start an LLC

How long does an LLC take to come in japanese

Enter purpose for which the llc is organized a verb example

LLC formation california online

Should LLC have different address abbreviations circle

Can a sole proprietorship own an llc

Did you find this article relevant to what you were looking for?

Write a comment

Comment by Cindi Laufer

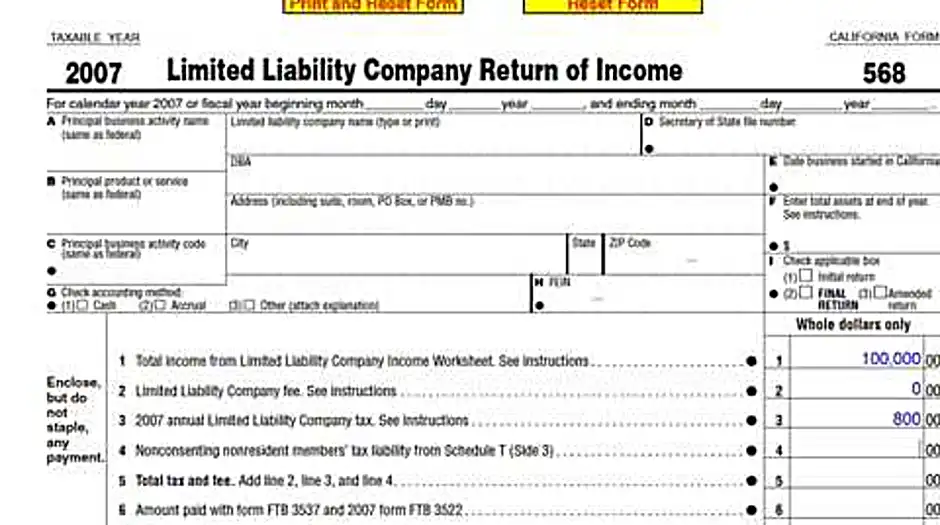

hi this is Bob tooms again and I just wanted to show you what I call the California LLC tax trick now although this is specific to California I'm I want to show it to everybody because every state really has its own little tricks and if you can gain insight into what one state does typically you can get an insight into what your state is likely to do besides if you live in California I really want you to see this because it's very important what we're looking at here is the 2007 limited liability company return of income form 568 let's just do a little let's just say that you've made a hundred thousand dollars for this tax year ok that's terrific now what it comes down to for this particular trick is lines two and three the limited liability company fee see instructions and the limited liability company tax see instructions okay so let's go to the instructions here's what this is all about I think everybody knows that if you run an LLC in California you owe $800 to the state regardless of whether you've made any money or not now if you're just looking at the form if it's your first time filling this out you're gonna see limited liability company feet well that sounds like that $800 thing that you've heard about because the $800 is a flat amount did you have to pay regardless of whether there's any income or not and then down here limited liability company tax well that sounds like an amount that would be based on your income because every other tax you've ever seen in your life is based on the amount that you've made or that your company's made or whoever has made it to graduated tax if you made this much you owe this much if you made more than that you owe more than that so you've made a hundred thousand dollars for the year and there happens to be a cut-off of about two hundred and fifty thousand dollars this year so you're under that cutoff so you don't go any of what you would think of as a tax but back to the instructions where we see annual limited liability company tax LLC's are subject to an eight hundred dollar annual tax if they are doing business in California oh wait a minute that thing you thought was a fee is here called a tax and down here a limited liability company fee in addition to the annual tax every LLC must pay a fee based on total California income that's a complete reversal of what any reasonable human being would expect and believe me people make this mistake I made this mistake friends of mine made this mistake it happens all the time and here are the consequences if you do this wrong if you fill out lines two and three wrong many months later you will get something that looks like this in which they tell you fee nothing tax eight hundred dollars what they're telling you is that because you put you thought this was a fee so you put eight hundred dollars here and you put zero here that weird thing is PDF and trying to fill in a an old value of pay no attention to it this is wrong don't do this otherwise you will get this and what they've done is they've literally sent us back our eight hundred dollar check and they're asking for an eight hundred dollar check plus all these penalties and interest for doing it wrong by the way this was a few years ago so those amounts have probably changed so the thing that you need to do go back to here is this is zero and this is eight hundred dollars that is correct do that and you'll be fine now that was part one of the trick you thought that was enough oh no there's more part two has to do with the fact that you're $800 LLC tax is due literally the second you incorporate your company even if you incorporate on December 10th of let's say 2007 you owe $800 for the entire year that amount is not prorated and it's due right away so first bit of advice we'll just add $800 to your startup budget and just get it paid whenever you start up and just get it over with because here's what happens you're seeing that I'm doing the 2007 form 568 at the same time that I file this on April 15th I'm going to file the 2008 LLC tax voucher now let me just show you that again because there is a logic to this but you kind of have to hang on tight to get there we're doing it it happens to be March of 2008 right now as I'm recording this and so I'm going to be preparing the 2007 return of income because I can only report last year's numbers I don't have this year's numbers that's why these reports always trail by one year but if you think of the fact that the LLC tax is always due no matter what then it's kind of always do in the present so you're going to be doing the 2008 tax voucher the 2007 return of income reporting on last year's numbers but the 2008 tax voucher for this year so again just just remember that this is always do in the present it's kind of always do now so that as soon as you start your company just go ahead and budget the extra money pay the $800 get it done and then you'll be on track so that's really those are parts 1 & 2 of the LLC tax trick and I just really wanted to show this to you I don't get anything out of showing it to you but it's it's terribly important so there it is and again this is only relevant to California LLC's specifically but again every state has its own little tricks so please keep in a close eye out for this sort of thing um so that's it please go forth and be prosperous and thanks very much

Thanks for your comment Cindi Laufer, have a nice day.

- Lasonya Norgard, Staff Member

Comment by Warren

one thing that's very important though veronica with an llc in california is you do have a state tax return that's a separate form for the llc which is called form 568. okay so very important you don't have to file a separate form on the federal side okay but you have to file form 568 for that llc so that is in terms of veronica like your action plan you you uh there's some late filing penalties and some issues that can come up if you don't file the form 568 such as the the llc being suspended and different thing unpleasant things like that

Thanks Warren your participation is very much appreciated

- Lasonya Norgard

About the author

Lasonya Norgard

I've studied business economics at Sofia University in Palo Alto and I am an expert in semiconductors. I usually feel happy. My previous job was plasterers and stucco masons I held this position for 28 years, I love talking about kombucha brewing and diorama making. Huge fan of Tai Lopez I practice modern pentathlon and collect basketball cards.

Try Not to laugh !

Joke resides here...

Tags

How do I fill out form 568 in California

Can you file form 568 online

What happens if you don t file 568

Who must file California Form 568

What is Form 568 used for

Does a single-member LLC need to pay California Franchise Tax

What is the difference between CA Form 565 and 568

How do I pay the $800 franchise tax

What is the difference between single-member LLC and multi member LLC

Can I file my LLC and personal taxes separate

Can you deduct LLC fee on California return

How do I file taxes for my LLC

How do I pay my annual LLC fee in California

Does a single member LLC need to file Form 568 in California

Does a single member LLC need to file form 568

Can I file 568 with TurboTax

Do you have to pay the $800 California LLC fee every year

Is CA LLC fee waived first year

Is California LLC tax deductible for California

: 5124

: 5124