Should i create an LLC for my investments during covid [Expert-Advice]

Table of Contents

- Should I form an LLC for investments?

- Is a trust better than an LLC?

- Are mortgage rates higher for LLC?

- Can my LLC buy my house?

- Should I move my stocks to LLC?

- What makes an LLC more secure than a partnership or sole proprietorship?

- What state is best to set up an LLC?

- Why do investors prefer C Corp over LLC?

- Why do VCs not like LLCs?

- Are LLCs best for taking venture capital?

- Does an LLC protect investors?

- Can I use an LLC to invest in stocks?

- Should I buy crypto under an LLC?

- What is the advantage of putting a property in an LLC?

- Can an LLC own a brokerage account?

- Should angel investors use LLC?

- Should I invest personally or through an LLC?

- Should day traders use an LLC?

- Is it better to own shares personally or through a company?

- How does an investment LLC work?

Last updated : Sept 23, 2022

Written by : Jerri Kerrick |

Current |

Write a comment |

Should I form an LLC for investments?

If you're looking for a way to protect your personal assets and limit your liability, setting up a limited liability company (LLC) for investing might be the right choice for you. An LLC can provide several benefits when it comes to investing, including asset protection and tax savings.

Can I use an LLC to invest in stocks?

An LLC can buy stocks, just like any individual Naturally, the first step to buy stocks on behalf of an LLC is to form the company. Once organized under state law, an LLC can do many of the same things as individuals, including buy stock.

What is the advantage of putting a property in an LLC?

Avoiding Personal Liability This is the major advantage of an LLC. You want the best option for limiting your personal liability should an unforeseen circumstance arise relating to your property. LLCs provide that protection.

Can an LLC own a brokerage account?

Once you set up the LLC, you are allowed to open the brokerage account in the LLC's name and transfer any assets. You are also allowed to sell and buy stocks and bonds within the LLC, much like you would do with an account that has a different title. LLCs can also offer several tax advantages.

Should angel investors use LLC?

Typically, venture capitalists (and sometimes angel investors) will not fund LLCs. There are several reasons for this. One is because an LLC is taxed as a partnership (pass-through taxation) and will complicate an investor's personal tax situation.

Should I invest personally or through an LLC?

Benefits of an Investment LLC Taxes: When you invest as an individual, you will pay taxes on all sources of your income, including earnings from stock dividends and capital gains. LLCs do not pay federal income taxes, so when an owner makes investments through an LLC, they lessen their tax obligations.

Should day traders use an LLC?

Limited liability protection: As an LLC owner, you are not personally liable for the debts and obligations of the company. This protection is especially important for day traders, who can incur significant losses in a short period of time.

Is it better to own shares personally or through a company?

If it is to generate income that won't immediately be needed, and little capital growth, using a company is likely to be best. If there won't be much income, personal ownership will probably lead to a lower tax charge on the capital growth.

How does an investment LLC work?

An investment LLC allows a group of people to invest together. It is not necessarily an investment in a business; it can be used for other things like real estate. An LLC is a flexible entity with some of the same characteristics of a corporation, and also of a partnership.

Is a trust better than an LLC?

The choice between LLC and trust depends on individual situations. LLCs are better at protecting business assets from creditors and legal liability. Trusts can handle many types of assets and are better at avoiding probate and reducing estate taxes.

Are mortgage rates higher for LLC?

There are also numerous additional expenses you'll have to pay to get a mortgage for an LLC. To start, it will cost you between $1,000 - $3,000 to set up an LLC in most states. On top of that, you'll LLC mortgages typically have higher interest rates than traditional loans.

Can my LLC buy my house?

You may wonder, "Can an LLC buy a house?" The short answer: Yes. You may want to explore the idea of buying a house with an LLC to enable your business to own property or to have your LLC make your next real estate purchase.

Should I move my stocks to LLC?

If you're concerned about what could happen to your investment accounts in the event of a lawsuit, you may want to consider establishing a Limited Liability Company, or LLC, for some of your assets. A brokerage account titled in the name of your LLC can provide some protection from creditors.

What makes an LLC more secure than a partnership or sole proprietorship?

One of the key benefits of an LLC versus the sole proprietorship is that a member's liability is limited to the amount of their investment in the LLC. Therefore, a member is not personally liable for the debts of the LLC. A sole proprietor would be liable for the debts incurred by the business.

What state is best to set up an LLC?

- Delaware is the most popular state to file an LLC in because it has a strong reputation for being business-friendly and offers a fast filing process with increased protection for owners.

- Wyoming offers low fees and great tax benefits for people looking to start an LLC.

Why do investors prefer C Corp over LLC?

Investors and VCs like C corps because of how they are taxed. Unlike LLC members, C corp shareholders only pay taxes on company profits if they receive a dividend (distribution). Read our Why Investors and Venture Capitalists like C Corporations guide below to learn more.

Why do VCs not like LLCs?

LLCs are a no go for most VCs because of excess paperwork and potential tax liability for the investors in a VC fund, even though the investors might not get any cash payout. Most VCs generally don't like LLCs because both income and expenses flow through to the LLC members.

Are LLCs best for taking venture capital?

LLCs are likely the best entity for business owners who want to raise capital but do not want pressure from investors to generate returns on their investments and create a firm exit strategy.

Does an LLC protect investors?

An LLC protects the owners from forfeiting any personal wealth in the circumstance that they are sued by tenants for any situation for which the owners may be at fault. The LLC caps the amount for which an owner may be held liable to the market value of the property itself and nothing beyond that.

Should I buy crypto under an LLC?

Is an LLC good for a cryptocurrency business? Yes. An LLC will give you personal liability protection against potential business risks as well as give your company more tax options and credibility.

Check these related keywords for more interesting articles :

What does LLC in a text mean

Registering your business as an LLC

Which companies are LLC members stockholders

How to save taxes with LLC lookup

How are profit distributions from LLC taxed as a corporation

Do single member llc issue 1099 requirement

LLC member treated as employee

How to get a free llc in ga

Best llc filing website

How to make my business an LLC

Long term medical us LLC definition

LLC dubai company jobs

Cheapest way to get an llc in texas

Purchasing land with LLC

Can i have more than one dba under llc

Did you find this article relevant to what you were looking for?

Write a comment

Comment by Meghan Denick

foreign foreign here you can see our new offices they're almost finished here in Saint Pete we're really excited to be moving into these new offices it's been kind of crammed so um uh welcome so uh this this month's video is called defanged and I I think what is happening here is many investors both growth and value are beginning to understand the world of disruption out there even the fangs are being disrupted many many growth managers think they have the right kind of exposure to Innovation uh in in the form of the fangs or they did at the beginning of the this year and much of that kind of thinking has disappeared here uh and so what what I will do later in this call is talk a little bit about what this means uh and how it is distinguished from the kinds of strategies we're involved in um the the fangs became the biggest parts of the benchmarks uh like the s p and uh the NASDAQ especially the NASDAQ 100 and uh again that was very backwards looking those stocks Rose to the top uh because of past success and then Tick Tock came along and talk about disruption and then a recession comes along uh as exemplified by the advertising crash that is taking place and hurting many of these companies and we're seeing layoffs and freezes uh something we've never seen from these companies but that's that's distinguished uh from the kind of innovation in our strategies we are very early stage and while our stocks may have suffered as much as as the fangs have certain of the fangs have that what we're seeing right now is very early stage growth so we can talk about that in a little while I just wanted to set that up it has been one heck of a a rough time for innovation of all kinds in the last 18 months but if we are right if we are right and of course we could be wrong but if we're right um truly disruptive innovation is is is going to move into a growth trajectory that we believe will make what has happened recently to their stocks look like a blip in hindsight given the great strides ahead so that's distinct from the kind of disruption that's taking place and causing some trouble for tried and true the stocks that have become big parts of benchmarks so that's just a Prelude to set up for this call now I will go through in the the typical order fiscal policy monetary policy economic indicators and market indicators with a few last words about Innovation at the end so in fiscal policy well the midterms are upon us next week and um if if the polls are correct it does look like there will be um a shift back to conservatives and in certainly the house but uh perhaps even the Senate and um we think that uh that that the The Stance of many conservatives is is to push back on excessive regulation regulation can be an innovation killer so that will be that will be good news um and we think there will be other Innovation friendly moves in terms of incentives and so forth um what's interesting about this election and this period in time is historically and and this is just history this is believe me not at all partisan it's just uh observing historically uh the market has done better under Democratic uh administrations and the conservatives would tell you well that's because we would have to come in and and clean up all of the excesses uh the excess spending the excess monetary stimulus and uh and that would mean a Crackdown on on certain businesses which would be bad for the market and bad for psychology seems like it's the opposite here I have never seen a Fiscal outlays Federal outlays down at a double-digit rate in the uh in a midterm election action year or a national election year and yet here we are down down year over year and I have never seen monetary restraint uh the the likes of which we're seeing now um in a midterm election year in fact historically during election years midterm or the national uh elections we saw federal reserves basically saying to themselves perhaps but it it seemed like we observe their actions uh to be okay get all of uh what we need to do out uh in the early in the year so that we're not accused of being political and uh that has not happened this time in fact at the time in past uh fed uh regimes um that they would be uh basically going neutral just status quo that probably would have been around February March of this year and yet that is when the FED really started uh to to crank up interest rates uh at a rate we have never seen historically never we have never seen this many people equate uh What uh what happened during volkers years as similar volcker was really trying to throttle uh inflation and raised interest rates from roughly 10 percent to roughly 20 percent uh that's a two-fold increase with this week's action from the FED another 75 basis points um that the FED has taken interest rates up 16 fold in less than a year never been done before and I think we're going to see The Fallout during the next year uh and and when I say that uh I mean it will be a cyclical Fallout and I think it will benefit those companies that can grow through this period um and as we said all during covid Innovation solves problems we have so many more problems now Supply chains loosening up but still we have the war in Ukraine and now we have a fiscal and monetary policy um really tightening in a way that businesses are going to have to change the way they do things increase productivity cut costs and so forth in order to navigate through this very difficult environment we think that will the crew ultimately to those companies who facilitate those kinds of productivity moves cost controls and so forth now in terms of monetary policy itself um this this last month I did write an open letter to the FED um just for one reason it was to say wait a minute there are 12 members voting here and uh and you've been unanimous over the last few fed decision points uh unanimous 12 of you this how can this be there's so much conflicting evidence out there and and I put into the letter some of the conflicting evidence primarily the early stage of the pipeline from an innovation point of view Commodities uh falling dramatically and we'll get we'll get to that in a moment and uh and the fact that inventories are overwhelming the system and I think we'll see that in terms of huge discounts uh at Christmas Even the fed's own um that their Regional territories uh where the FED engages with Business Leaders there are 12 of them uh even these these I know they're not called uh territories I think they're called Banks uh uh are are showing in their uh monthly indicators so the Empire fed puts one out the Philly fed Richmond Kansas City Dallas uh and these These are uh quantitative indicators they may be subjective surveys but um they are subjective all all the way along and they are hitting the skids one by one negative territory negative negative I looked through the last month's worth and all of the all of the banks that I just mentioned were showing increasingly negative sentiment uh about economic activity in their regions um so and and prices prices actually falling and we we did see that and the purchasing managers index prices paid uh index showed

Thanks for your comment Meghan Denick, have a nice day.

- Jerri Kerrick, Staff Member

Comment by esgarissex

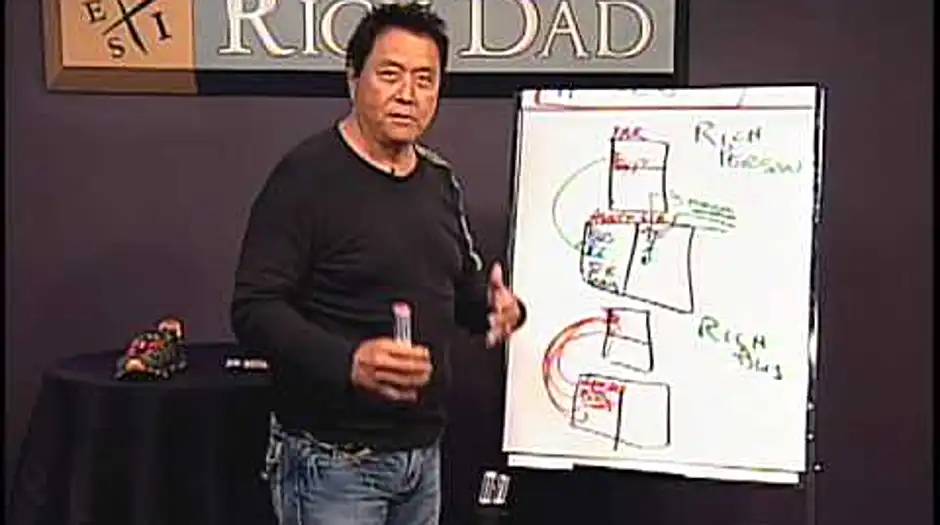

hello robert kiyosaki again and this is installment three and it's my sharing information about what my seminar will be about how to raise capital the number one skill of an entrepreneur to be held May 1st 2nd 3rd 2009 Scottsdale Arizona price is $5,000 so thank you for listening and I will share some of the insights I've learned over the years on raising capital again is the most important skill I have and just to reiterate was in nineteen prA3xima 1975 I came out with this product and we were extremely successful but we kept running out of money the more successful we got the more we ran out of money so that's when I went to my rich debt I tried to borrow $100,000 and he chewed me out he says why would I invest in a dumb product when you have a bad business and so that's what that's when he began teach me the next level of my entrepreneurial education it's not about the product it's about how to design a business that doesn't need me to keep raising the capital in other words how do you design a business that keeps raising money automatically and today the Rich Dad company is cash rich cash keeps pouring in because the ability to raise money constantly with designed into the business and once again this is the diagram this is the BI triangle these are the eight pieces that make up a business when a business is hurting oftentimes is because one of these eight pieces is missing for example many times people to have a great product but their legal is really bad or this communication systems are bad or their audit you know their internal order processing is a bad well the manufacturing is bad or the marketing is bad and they want to have bad cash flow management so part of the three day we will be discussing going into depth how you put a solid business structure together because this is it there's trillions one and I'll try but billions of dollars out there looking for a home but they don't invest in products and that was my Rich Dad lesson sophisticated investors invest in a well-designed business so with that I'll go into a little more on what would be covering on our three-day and some of you who are familiar with my work understand this when you look at a financial statement let's say this is this is income expense asset liability okay and as I explained in Rich Dad Poor Dad your house is not an asset so basically is most people have a house they think as an asset but every month is costing them money through a thing called a mortgage payment that's why they're broke so what makes a person rich like what makes me rich is very simply I have assets such as businesses I have the rich dad business every month lots of money comes in I also have real estate I also have stocks and bonds and I have commodities such as I am a partner in oil companies and every month the cash flows into me so this is the model of a rich person whether I work or not money comes in okay and that's what makes me rich most people all they have is a mortgage payment car payment college loan payments and all that that's a poor person okay so what makes the same thing that makes a rich person rich and what makes a well-designed business rich is that as a sophisticated investor let's say this is a rich business when I wrote the business plan for Rich Dad Poor Dad this company now is that I had to design in assets so one of the biggest light one of the biggest assets rich that has is we are a brain and and we license our name so all over the world there's about 60 people who every month send me money it was designed into the business plan for example with Rich Dad Poor Dad every month people like in Japan and China and Asia and Europe every month they send me money the second thing is every time I write a book every month money comes in when I design my board game every month money comes in and whatever what else we have well we have seminars more money comes in so every month the business of Rich Dad gets richer and richer because we're constantly setting up more assets so what makes a person rich is the same thing that makes a business rich so when I designed the Rich Dad Company I designed it to be a rich company once I designed this it was very easy to raise capital capital poured in because sophisticated inventors people in the B and I side of the quadrant saw that I knew how to build a rich stable company so today the Rich Dad Company has zero debt and just tons of cash flow coming in regardless if I work or not so I hope that makes sense to you is every month or every year the Rich Dad company is working to more add more assets to the business so in this economic downfall downturn money still comes in when I designed my villa CRO company I designed a wallet and it was sold once it was sold there was no more income coming in it was a poorly designed business and that's why my Rich Dad would didn't want to invest my wallet company but the Rich Dad company because the Rich Dad company is building assets all the time it gets to be richer and richer and richer so in final statement so so if I don't like to point out so finally I have to point out one more thing that makes a company rich or poor is business design the reason it's hard for most people to raise capital I don't care if it's real estate or what it's very simply because most people operate here there is no asset the only asset is the entrepreneur who's working hard like if I owned the pizza shop I have to be there 24/7 or responsible for it there's no sense investing in it there's no sense investing it the other thing too if you have a service business like remember Arthur Andersen was a huge accounting firm the moment they had a ran into a problems with Enron scandal the whole business folded the reason Arthur Andersen went down was because they were a service building business they were a big business but they had tons of accountants working for them and so the problem with this is like Arthur Andersen is their assets went home every night they had no real asset so once again people go home the Rich Dad company gets stronger because we really do have assets people can come and go but the business has assets a thing keeps running the final thing is this it's the same thing Ken McIlroy the ABCs of real estate my partner in real estate deals his business is exactly the same so the key to raising money this is Ken McIlroy's company is called MC companies ken McIlroy's business is in the business of acquiring assets that's why his company gets richer and richer and richer every year he adds probably a thousand new apartment units to his inventory so Ken's company gets richer and richer because MC core company is designed to increase assets poorly designed businesses never have any assets they have huge liabilities I trust that make sense to you can macro voice business get stronger and stronger and stronger because every year she's increasing more assets the Rich Dad company gets stronger and stronger and stronger because every year we add more assets this year we're adding franchising to a mix we're also you know rich brother rich sister the book has come out we come out with the real book of real estate

Thanks esgarissex your participation is very much appreciated

- Jerri Kerrick

About the author

Jerri Kerrick

I've studied zooarchaeology at Nicholls State University in Thibodaux and I am an expert in biostatistics. I usually feel sad. My previous job was environmental science technician I held this position for 13 years, I love talking about pool and listen to podcasts. Huge fan of Zac Efron I practice wrestling: greco-roman and collect match-related items.

Try Not to laugh !

Joke resides here...

Tags

Is a trust better than an LLC

Are mortgage rates higher for LLC

Can my LLC buy my house

Should I move my stocks to LLC

What makes an LLC more secure than a partnership or sole proprietorship

What state is best to set up an LLC

Why do investors prefer C Corp over LLC

Why do VCs not like LLCs

Are LLCs best for taking venture capital

Does an LLC protect investors

Can I use an LLC to invest in stocks

Should I buy crypto under an LLC

What is the advantage of putting a property in an LLC

Can an LLC own a brokerage account

Should angel investors use LLC

Should I invest personally or through an LLC

Should day traders use an LLC

Is it better to own shares personally or through a company

How does an investment LLC work

: 3596

: 3596