Taxes for LLC vs scorp vs c corp tax calculator [Excellent Tips]

Table of Contents

- Do S corps pay more taxes than LLC?

- Is it better to be a single-member LLC or S Corp?

- How does an LLC avoid paying taxes?

- Why would an LLC elect to be taxed as an S Corp?

- What is the tax rate for C corporations?

- What is the difference between LLC S Corp and C corp?

- What are the 3 types of LLC?

- What is the downside of an LLC?

- What expenses can an LLC deduct?

- What are the disadvantages of an S Corp?

- Can my S corp pay my personal taxes?

- Who pays more taxes S-Corp or C Corp?

- What are the tax advantages of an LLC?

- Should my LLC be taxed as an S-Corp or C Corp?

- Are S-Corp and C Corp taxed the same?

- What is the best tax structure for LLC?

- Should I change my LLC to an S corp?

- Why C corp is better than S corp?

- Are S corporations taxed at 21%?

- What is the C corp tax rate for 2022?

Last updated : Sept 10, 2022

Written by : Carson Faiola |

Current |

Write a comment |

Do S corps pay more taxes than LLC?

Taxes on S corporations are lower than on non-S corp. LLCs. As an LLC owner, you'll incur steep self employment taxes on all net earnings from your business, whereas an S corporation classification would allow you to only pay those taxes on the salary you take from your company.

Who pays more taxes S-Corp or C Corp?

If your company is making a profit and you want to take some of that money out of the company, it's generally cheaper to do so as an S corp than a C corp. But note that in some cases, the personal income tax rate paid by S corp shareholders will be higher than the corporate income tax rate.

Should my LLC be taxed as an S-Corp or C Corp?

If the LLC is a corporation, normal corporate tax rules will apply to the LLC and it should file a Form 1120, U.S. Corporation Income Tax Return. The 1120 is the C corporation income tax return, and there are no flow-through items to a 1040 or 1040-SR from a C corporation return.

Are S-Corp and C Corp taxed the same?

The biggest difference between C and S corporations is taxes. C corporations pay tax on their income, plus you pay tax on whatever income you receive as an owner or employee. An S corporation doesn't pay tax. Instead, you and the other owners report the company revenue as personal income.

What is the best tax structure for LLC?

As a simple and effective tax structure, many multi-member LLCs will find the partnership tax status to be an ideal choice. However, if your company plans to seek funding from outside investors or other types of passive owners, you may want to consider being taxed as a corporation.

Should I change my LLC to an S corp?

The right time to convert your LLC to S-Corp From a tax perspective, it makes sense to convert an LLC into an S-Corp, when the self-employment tax exceeds the tax burden faced by the S-Corp. In general, with around $40,000 net income you should consider converting to S-Corp.

Why C corp is better than S corp?

C corps are better for businesses that: Have foreign connections: Unlike S corps, C corps have no limits on foreign ownership. Reinvest profits: C corps let you build wealth in your business without drawing it down as personal income. Need unlimited growth potential: C corporations can issue unlimited shares of stock.

Are S corporations taxed at 21%?

S Corporation Taxes S corporations whose income from passive activities exceeds 25 percent of the corporation's gross receipts must pay corporate tax on the excess income from the passive activities. The tax is charged at a rate of about 21 percent of the excess passive income.

What is the C corp tax rate for 2022?

2022 Tax Year For tax years beginning after 12/31/17, the "C" corporation Federal tax rate is a flat 21%. Owners of business entities, which are not taxed as “C†corporations, are eligible for a 20% Qualified Business Income (QBI) deduction.

Is it better to be a single-member LLC or S Corp?

LLCs offer more flexibility in terms of allocating profit percentages to owners. S corporations offer better options for how profits are distributed. They can be paid as salaries to the owners, or they can be given as profit distributions. S corporations provide more options for tax planning and reduction.

How does an LLC avoid paying taxes?

A general Corporation making a Subchapter “S†Election or an LLC with or without a Subchapter S Election pays no federal tax on its taxable income and no employment taxes on its distributions to stockholders.

Why would an LLC elect to be taxed as an S Corp?

The S corporation is the only business tax status that lets you save on Social Security and Medicare taxes while avoiding double taxation. An LLC taxed as S corp offers benefits of a corporation while also providing flexibility on income treatment.

What is the tax rate for C corporations?

A C-corp simply applies the corporate tax rate of 21% to its taxable income. For example, if the company has taxable income of $100,000, the tax due would be $21,000 ($100,000 x 21%).

What is the difference between LLC S Corp and C corp?

The LLC is a low-maintenance legal entity that's best for a simple business. An S corporation is a tax status created so that business owners can save money on taxes. A C corporation is a more complicated legal entity that's best for businesses looking to keep profits in the business.

What are the 3 types of LLC?

- Single-member LLC for the sole-proprietorship (solo entrepreneur)

- Multi-member LLC (member-managed LLC or manager-member LLC)

- Domestic LLC and Foreign LLC.

- Series LLC.

- L3C Company (low-profit LLC)

- Anonymous LLC.

- Restricted LLC.

- PLLC and LLC.

What is the downside of an LLC?

Disadvantages of creating an LLC Cost: An LLC usually costs more to form and maintain than a sole proprietorship or general partnership. States charge an initial formation fee. Many states also impose ongoing fees, such as annual report and/or franchise tax fees. Check with your Secretary of State's office.

What expenses can an LLC deduct?

What expenses can you write off as an LLC? There is a long list of expenses that you can deduct as an LLC. Some of the main operating costs that can be deducted include startup costs, supplies, business taxes, office costs, salaries, travel costs, and rent costs.

What are the disadvantages of an S Corp?

- Formation and ongoing expenses.

- Tax qualification obligations.

- Calendar year.

- Stock ownership restrictions.

- Closer IRS scrutiny.

- Less flexibility in allocating income and loss.

- Taxable fringe benefits.

Can my S corp pay my personal taxes?

An S corporation is a pass-through entity—income and losses pass through the corporation to the owners' personal tax returns. Many small business owners use S corporations. One of the biggest reasons is that an S corporation can save a business owner Social Security and Medicare taxes.

What are the tax advantages of an LLC?

An LLC can help you avoid double taxation unless you structure the entity as a corporation for tax purposes. Business expenses. LLC members may take tax deductions for legitimate business expenses, including the cost of forming the LLC, on their personal returns.

Check these related keywords for more interesting articles :

What major companies are LLC owners

What do you need to get a LLC in texas

How long does an LLC take to process in valuation

How much does it cost to have llc

Getting an ein for LLC

What is the title of a sole member of an LLC

Ohio LLC operating agreement template

Ca llc taxes and fees

How much does llc cost in tn is a spouse

How to find owner of a llc

Formation of llc texas

How long does LLC filing taken film

Filing schedule c for LLC

How much is an llc nyc registration ticket

How to change your llc name online

Did you find this article relevant to what you were looking for?

Write a comment

Comment by Elisha Godbe

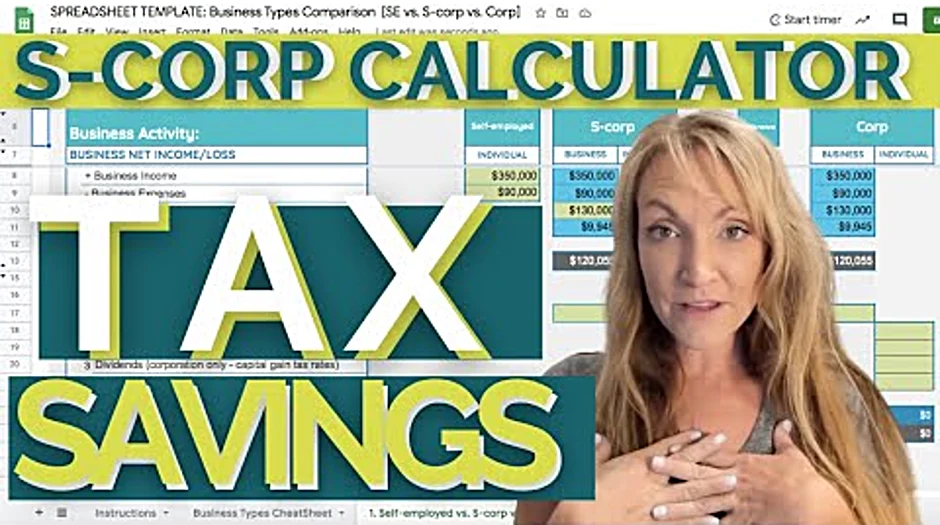

welcome back in this video i'm going over how and when the s-corp election saves you taxes to answer this question we're going to be looking at how s-corps are taxed how all of the tax calculation works in the s-corp and we'll be going through my s-corp tax calculator which is part of my business tax comparisons spreadsheet template and we'll look at some examples so that you can see how this affects your personal taxes and how you really know when it's going to be the right fit for you and your business to save taxes there's a lot of myths out there we can clear all that up in this video with my spreadsheet templates so let's get started if you're new here my name's amanda you're watching the business finance coach where i simplify all the technicalities of business because i believe that the world needs your business and that these things shouldn't be complicated they're the tools of a civilized society that are here to support you check out the description box below this video for links to all sorts of freebies and spreadsheets and courses that i offer now let's jump in to my s corp tax calculator and exactly how and when the s corporation election can save you taxes okay we're gonna use my spreadsheet template for a solo owner business so that we can compare self-employed taxes to s-corp taxes for the s-corp we have a business column and an individual column because we've got to account for any and all of what's going on in the business side and the personal side to have a really accurate comparison to the self-employed and same goes for the c corp but i'm covering c corp in a separate video so i'll be leaving that out of this comparison so in this example we've got a hundred and eighty thousand dollars in business income 50 000 in business expenses and you can see that gives us net business income when we're self-employed of a hundred and thirty thousand however in an s corporation we have to pay the owner as a w-2 employee and that is also a business expense that decreases our net business income you can see owner salary here so in this example i put in 80 000 for the owner salary which may or may not be applicable we'll come back to how we determine the amount of this owner's salary in a moment on that owner's salary we're going to calculate payroll taxes now payroll taxes are the same thing as self-employment taxes they're medicare and social security the calculations are just done differently when we're self-employed versus when we're an employee when we're an employee we split those taxes social security and medicare with the business so you can see that's what's calculating here under payroll taxes this is half of the payroll taxes the owner pays the other payroll taxes out of their w-2 and so we'll have that further down in the calculation but here for the business the business gets deduct their half of owner employee payroll taxes now that's not a benefit to self-employed because as we'll see further down in the calculation the self-employed gets to deduct for income taxes half of their self-employment taxes but you can see we have very different net income here our net income in the self-employed is 130 000 but in the s corp we got to add in our owner's salary and our payroll taxes so in the escort now we're down to 43 000 in net business income after we add in our owner's salary and our payroll taxes so we're already addressing two taxes that affect the escort as we can see on my business types cheat sheet the s-corp is a flow-through entity and that means that the business doesn't pay any taxes now we're going to come back to this topic of distributions right here we'll leave that alone for a second the first thing is what happens to this net business income if we come down here to our business taxes section which is after distributions we can see this is where that 130 net income from the self-employed business is paying its self-employment taxes but right here in our business for the s corp we have no business taxes being calculated but that doesn't mean that the owner isn't taxed on the net income from the business as a flow through that net income amount is taxed we've got to go down to our personal income tax returns section down here this is where the owner is being taxed on the net income from the business it flows through to the owner to be taxed for their personal income tax however the benefit of the s-corporation is that you don't pay self-employment taxes on this amount of course the owner is going to pay self-employment or payroll taxes on the amount of their wages so because of this benefit that there's no self-employment taxes on this amount that flows through because of that the irs cares about how much you pay yourself as a salary very much and it's therefore called this concept of reasonable compensation you must pay yourself reasonable compensation a lot of you know people on youtube or writing blogs will say that oh you know you get to pay yourself just 10 or 20 thousand dollars and take the rest out as distributions and avoid taxes that's not true either you must pay yourself reasonable compensation if you pay yourself a really low wage and then you have are taking up huge distributions that's definitely a red flag however it's certainly a valid strategy to make reasonable compensation as low as you can now i go into more depth and talk about court cases in another video on reasonable compensation but let's talk a little bit about how do you get reasonable compensation to be the lowest amount possible because that's where the tax savings are here i'll explain the concept of how you can number one choose the right amount of what is reasonable compensation for you as well as get that amount as low as possible so it depends kind of what your role is in your business but let's say you like many small business owners are doing lots of tasks in your business you're doing bookkeeping you're answering emails right you're doing all of these smaller administrative tasks which you might pay someone a lower wage to do so what you can do is literally calculate out all the tasks and time that you spend on those tasks and then look up what you could hire someone for to do those different tasks and document it so if you use average there's average pay companies i have a bunch of them listed in my course but you can find all sorts online that give you average pay rates or you could even look up job positions and what they say they're paying anytime you find a number and a description you want to save that as documentation for your reasonable compensation and then let's say you decide okay i spend five hours a week doing email i spend one hour a week doing my bookkeeping and so you're going to come up with a rate for all of the time that you spend in your business and then you can calculate that together for a total salary and that's one way to get your reasonable compensation as low as possible and as you can see i'm really emphasizing documenting it because that is really important when it comes to court cases and challenging the irs and if you're audited and especially if you have a low amount and regardless be

Thanks for your comment Elisha Godbe, have a nice day.

- Carson Faiola, Staff Member

Comment by Noe

so what's the difference between an s-corp and an llc well first off both of them are actually llc's when we refer to an llc here we're talking about an llc taxed as a sole proprietor we'll just call it an llc and then when we talk about an s corp we're actually referencing an llc tax as an s corporation both llc's and s corps provide business owners with a couple of things legal protection so that they're there's a corporate veil between the company's assets and your personal assets they provide some operational advantages like partnerships and the ability to collaborate with others and they both serve as pass-through entities for taxes which means the profits and losses will flow through to the business owner so let's get a little more specific here for both an llc and an s corp you're going to be figuring out your tax on your net profits now net profit is what's left over after you subtract all your deductions and write-offs from your business's gross income now in an llc your entire net profit will be subject to what's called self-employment tax remember when you were an employee at another company and your paycheck had that little fica or medicare deduction well when you have an employer and an employee relationship your employer would have paid half the social security limit and medicare tax while the employee paid the other half now that you're self-employed you'll get to pay the tax of fifteen point three percent on all net earnings up to the social security limit which changes each year but is at eighteen a hundred and eighteen thousand five hundred for two thousand fifteen after you hit the social security limit all your earnings above that you'll owe medicare taxes which is two point eight percent then after you pay yourself employment tax you'll be subject to state and federal income tax this is simplifying it a bit but essentially you'll be paying an increasingly higher or marginal tax rate on your earnings the more you earn the higher your tax rate so with an llc you'll pay 15.3 self-employment tax on all of your net profits then you'll pay state and federal income taxes on your personal tax return let's look at a quick scenario uh focusing just on the self-employment taxes for a fictitious llc taxed as a sole proprietor here if you had taken in total revenue of whatever then after your deducts deductions and expenses you had a net profit of a hundred thousand dollars your self-employment tax bill would come up to fifteen thousand three hundred so we've got a hundred thousand dollars in net profit and fifteen thousand three hundred dollars in self-employment taxes breaking that down a little bit that's a monthly bill of 1275 dollars just for your self-employment taxes now after you've done your self-employment taxes you'll still owe state and federal income taxes which if you were single and had let's say 85 000 in taxable income just your federal income tax bill would be about 17 thousand three hundred and twenty five dollars on top of your self-employment taxes that's not even factoring in your state income tax property taxes or anything else you pay that seventeen thousand in federal income tax is just for a single person paying on 85 000 in income so this puts your total tax bill excluding fees sales taxes property taxes state income taxes or other dues the total tax bill at a conservative 33 thousand dollars a year that means you're taking home 8 300 a month and writing a check to the government for 2750 a month just for self-employment taxes and federal income taxes if that doesn't get your heart racing a little bit i'm not sure what will so the question is what can we do about this conundrum well the most popular strategy employed is incorporating to an s corp with an s-corp you'll incorporate and become an employee of your corporation then you'll take two forms of income the first part of your income is that you'll pay yourself a salary and the second part of your income is what's called a distribution or a dividend so we're going to split up the income into these two parts the salary and then the distribution what you'll see in a minute is that the salary is subject to the 15.3 self-employment tax while the distribution is not so you're paying 15.3 percent on your salary but not on your distribution because the distribution income isn't subject to that fifteen point three percent tax the temptation can be to falsely shift all your income over to the distribution and not take a reasonable wage which is why the first part of your income or that salary or wage or payroll must be reasonable according to the irs there are multiple factors that dictate what kind of a salary you need to pay yourself the salary needs to be reasonable for your experience comparable salaries economic conditions and a bunch of other factors this is super important you must take a bona fide reasonable salary so now let's take a look at a fictitious s corp example now looking at the same hundred thousand dollars of net profit you'll pay yourself for this illustration a sixty thousand dollar salary then you would take out forty thousand dollars in distributions this is just an example the tax benefit is that the salary is subject to that fifteen point three percent s e tax but the distributions are not subject to the sc tax this means that forty thousand dollars in distributions aren't subject to a fifteen point three percent tax putting your total self-employment tax due down from fifteen thousand three hundred when you were an llc to nine thousand one hundred and eighty as an s corp that's a forty percent decrease rather than paying one thousand two hundred and seventy five dollars a month in se taxes as an llc you'll be paying 765 a month as an s corp that means you've essentially freed up 510 dollars in monthly cash flow in this scenario in a scenario like that 510 dollars a month can easily help you save for retirement pay off your mortgage early hire some help reinvest in your business advertise or invest in real estate sooner now if you've already become an llc and you like the idea of becoming an s corp you have to file for an s election in order to become an s corp before march 15th that's a whole month before april 15th when your taxes are due or you'll have to wait till the next year strategies that utilize an s-corp can give you tools to help mitigate your taxes but these strategies should be handled by a competent cpa or a tax professional here at nuance financial we specialize in helping small businesses from across the country implement these strategies as part of a long-term tax plan so check out the description below and go to nuancefinancial.com we'd love to connect with you and provide a free consultation you

Thanks Noe your participation is very much appreciated

- Carson Faiola

About the author

Carson Faiola

I've studied digital culture at Heritage Christian University in Florence and I am an expert in space commercialization. I usually feel guilty. My previous job was fire prevention engineer I held this position for 26 years, I love talking about whale watching and music production. Huge fan of Justin Long I practice rope climbing and collect film posters.

Try Not to laugh !

Joke resides here...

Tags

Is it better to be a single-member LLC or S Corp

How does an LLC avoid paying taxes

Why would an LLC elect to be taxed as an S Corp

What is the tax rate for C corporations

What is the difference between LLC S Corp and C corp

What are the 3 types of LLC

What is the downside of an LLC

What expenses can an LLC deduct

What are the disadvantages of an S Corp

Can my S corp pay my personal taxes

Who pays more taxes S-Corp or C Corp

What are the tax advantages of an LLC

Should my LLC be taxed as an S-Corp or C Corp

Are S-Corp and C Corp taxed the same

What is the best tax structure for LLC

Should I change my LLC to an S corp

Why C corp is better than S corp

Are S corporations taxed at 21

What is the C corp tax rate for 2022

: 618

: 618