What major companies are LLC [Fact Checked]

Table of Contents

- How many LLCs are there in the US?

- How can an LLC avoid taxes?

- How much can an LLC write off?

- What can I write off as an LLC?

- How can an LLC avoid double taxation?

- Is an LLC a privately owned business?

- What are 10 small businesses?

- Why are LLCs so popular?

- Why do investors look for an LLC company?

- What are the tax benefits of having an LLC?

- What is the most common LLC Type?

- What types of businesses are best suited for LLC?

- What business type is an LLC for Amazon?

- What does LLC mean for dummies?

- Do LLCs pay taxes?

- What are the 4 main types of businesses?

- Why an LLC is the best option?

- How many types of LLC are there?

- How much does an LLC cost?

- Is Shopify an LLC?

Last updated : Aug 11, 2022

Written by : Gary Chapmon |

Current |

Write a comment |

How many LLCs are there in the US?

There are roughly 21.6 million LLCs in the United States. In comparison, there are approximately 1.7 million traditional C-Corporations, and approximately 23 million sole proprietorships.

What types of businesses are best suited for LLC?

LLCs can be a good choice for medium- or higher-risk businesses, owners with significant personal assets they want protected, and owners who want to pay a lower tax rate than they would with a corporation.

What does LLC mean for dummies?

A limited liability company (LLC) is a popular choice among small business owners for the liability protection, management flexibility, and tax advantages this form of business entity often provides.

Do LLCs pay taxes?

An LLC does not pay income taxes; rather, income is passed to the LLC's members, and they report and pay tax. Even though an LLC does not pay tax itself, it still must report its income to the IRS using an "information" return.

What are the 4 main types of businesses?

The most common forms of business are the sole proprietorship, partnership, corporation, and S corporation. A Limited Liability Company (LLC) is a business structure allowed by state statute.

Why an LLC is the best option?

The main advantage to an LLC is in the name: limited liability protection. Owners' personal assets can be protected from business debts and lawsuits against the business when an owner uses an LLC to do business. An LLC can have one owner (known as a “memberâ€) or many members.

How many types of LLC are there?

Today, each state governs LLCs in their own way; some recognize all 8 types while others only 5 or 6, and all have their own rules and regulations for running them. The good news is all 8 types of LLCs are tailored for every imaginable business need; you just need to find the right fit.

How much does an LLC cost?

You can file the LLC filing documents online, by mail, or in-person when visiting the local SOS office. The filing costs usually vary from $50 to $150 which is a single-time fee. If you plan to form your company in another state, then you might have to provide additional documentation and pay a higher formation fee.

Is Shopify an LLC?

Therefore we can say that Shopify stores can be run as sole proprietorships or LLCs. Although you might want to form an LLC or a corporation, it isn't required. To set up all legal details of your Shopify store, you typically only need your social security number or tax identification number (TIN).

How can an LLC avoid taxes?

An LLC can help you avoid double taxation unless you structure the entity as a corporation for tax purposes. Business expenses. LLC members may take tax deductions for legitimate business expenses, including the cost of forming the LLC, on their personal returns.

How much can an LLC write off?

If you have $50,000 or less in startup costs and are in your first year of business, the IRS allows you to deduct $5,000 in startup costs and $5,000 in organization costs from your taxes. If your startup expenses exceed $50,000, the total deduction will be reduced by however much your expenses exceed $50,000.

What can I write off as an LLC?

- Car expenses and mileage.

- Office expenses, including rent, utilities, etc.

- Office supplies, including computers, software, etc.

- Health insurance premiums.

- Business phone bills.

- Continuing education courses.

- Parking for business-related trips.

How can an LLC avoid double taxation?

Thus, the first way to avoid double taxation is to choose a business entity that is not double taxed. This includes forming a California Corporation and then electing S-Corporation status with the IRS. Many small business owners have nonetheless formed corporations without electing S-Corporation status.

Is an LLC a privately owned business?

Private companies are sometimes referred to as privately held companies. There are four main types of private companies: sole proprietorships, limited liability corporations (LLCs), S corporations (S-corps) and C corporations (C-corps)—all of which have different rules for shareholders, members, and taxation.

What are 10 small businesses?

- Cleaning service. Consider starting a cleaning business if you don't mind doing the dirty work others cannot do for themselves.

- Freelance Writing Business.

- Amazon Kindle Publishing.

- Daycare.

- Pet Grooming.

- Aerial Photography.

- Build and Sell Themes Online.

- Blogging.

Why are LLCs so popular?

A corporation requires a great deal of paperwork in filings, minutes of director meetings and other reports. LLCs avoid most of that paperwork. Corporations are also restrictive on who can be owners. There is no limit on the number of members an LLC can have.

Why do investors look for an LLC company?

Members are protected from financial and tax liability. The amount of members/investors an LLC can have is unlimited. Members share in profits and losses in proportion to their percentage of ownership. A manager's share of the profit is considered earned income and not self-employment tax.

What are the tax benefits of having an LLC?

- LLCs avoid double taxation while enjoying personal liability protection.

- LLC allows a small business owner tax deduction.

- Self-employment taxes are required.

- All profits are taxed regardless of income.

- Qualified Business Income deduction (QBI)

- Health insurance.

- Disability insurance.

What is the most common LLC Type?

- Company transactions.

- Taxes.

- Debts the business owes.

What business type is an LLC for Amazon?

Amazon Seller as an LLC You can also set up a business to sell on Amazon as an LLC (limited liability company). Unlike a sole proprietor who runs an unincorporated business, an LLC exists as its own legal entity separate from the owners.

Check these related keywords for more interesting articles :

Can a llc be non profit

Forming llc in pennsylvania

What is a registered agent for an LLC mean

How much will my LLC get taxed

Can an LLC change its tax classification

Long island electric utility servco LLC lookup

Does a period go after llc in texas

How to obtain a LLC in ohio

Best way to set up llc

How long does it take to set up an LLC in wisconsin requirements

The 5 of us LLC definition

Cost of forming an llc in ga

The duration of this LLC shall be deemed

Can an LLC be called a corporation

Legal documents services LLC

Did you find this article relevant to what you were looking for?

Write a comment

Comment by Jon Tomb

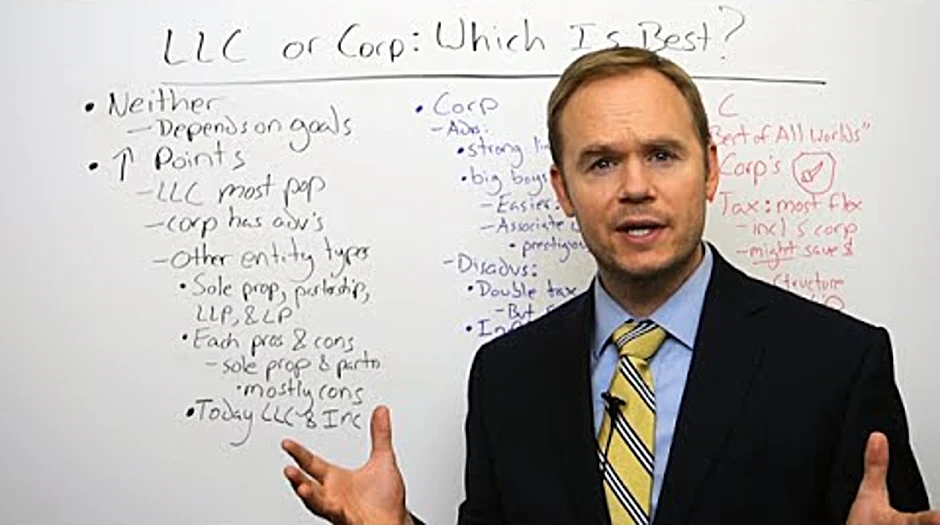

hello and welcome to an edition of Genesis Law Firm teaches today's topic is this one LLC or corporation which is better this is a very frequently asked question should I form an LLC a limited liability company or should I form a corporation for my new business the answer is that neither is necessarily the better option it depends upon you and what you want to accomplish with your business in this video we're going to go through the high points of this discussion which is better an LLC or a corporation LLC's are the most popular and any choice available including when compared to corporations but corporations do have their advantages by the way there are many other entity types out there you could be a sole proprietor a partner you could be a limited liability partnership a limited partnership and all of these entity types have their pros and their cons by the way if you form a sole proprietorship or a partnership there are probably more cons than pros usually you won't want to choose those two options you'll want one of these other options that I mentioned a limited liability entity like a corporation or LLC in today's video we're going to focus exclusively on LLC's in corporations because they are the most popular two entity types let's first look at corporations and their advantages corporations have a very strong liability shield for their owners in fact this is the reason why there are so many corporations out there when corporations first came into existence it was the only way that you could create an entity shield of this type so if you've really wanted to protect the individuals assets and only expose whatever might have been invested in the business then you would have chosen a corporation it's also what the big boys use if you want to be like a Microsoft or a Boeing and go public then you'll want to be a corporation similarly if you want to associate with the big boys if you want people to think that you're big even though perhaps you might not be if you want that kind of prestige then maybe you would form a corporation rather than an LLC disadvantages as I mentioned there are some drawbacks here one of the biggest is that if you form a corporation the way the big boys do you subject yourself to double taxation there's taxation both at the corporate level and at the individual level so most people won't want to form a business exactly like Microsoft or Boeing instead people who form corporations will at least initially choose to be taxed under the S corporation election and that means there's only one level of Taxation but you can only do this while the corporation is closely held and there are certain other restrictions the I think biggest reason why people might choose not to form a corporation would be the inflexibility of the corporate structure you're almost always going to have I shouldn't say almost always you're always going to have a board and executives and that can be a cumbersome way to do business most people would prefer to do business either in a way that's similar to a sole proprietorship or a partnership because of the ease and how the decisions are made next let's look at LLC's limited liability companies some people say that LLC's are the best of all worlds and I can't say that that's necessarily true but there are many advantages one of the big advantages is that you get a corporation's liability shield you get the same protection for the owners that a corporation provides that's unique among all the other entities out there so these are the two best in terms of their entity shields with an LLC you get the most flexibility in terms of how you choose to be taxed even more flexibility than with a corporation so if you're trying to save money tax wise and LLC might be a good choice but ultimately most businesses end up being taxed as S corporations regardless of whether they're a corporation or an LLC because they both make the same tax election so it may not be that there's a big tax savings by choosing to form an LLC versus a corporation but you might save some money the really big reason for forming an LLC would be the flexibility of the entity structure you can choose to structure this business almost any way you want including running it as a partnership which is what most people who have multiple owners of the business really want to do the biggest disadvantage of an LLC is that it's not what the big boys use if you intend to go public or you want to associate yourself with that kind of big business then perhaps an LLC is not the best choice for you bottom line an LLC is going to be better for most people and their businesses but you might choose to form a corporation instead if you want to go public maybe you're not ready to do it now but you intend to do it in the future or if you want to associate yourself with those big dogs and I should mention that you can form an LLC and convert it to a corporation at a later date so that might be how you would truly get the best of all worlds if you would like more information on this topic or related topics you can go to our website and you might want to click on the resources tab that's where most of our videos and articles are and if you would like the address for the article associated with the same topic that we're discussing today you can find it here

Thanks for your comment Jon Tomb, have a nice day.

- Gary Chapmon, Staff Member

Comment by Dana

what does an LLC and now I'll see your limited liability company is popular type of business structure due to its flexibility and simplicity if you're a small business owner or entrepreneur starting an LLC is one of the best ways to establish credibility and protect your assets watch this video to get a quick overview of the main features of an LLC how an LLC protects your personal assets how LLC's are taxed the importance of an operating agreement and using a professional LLC formation service at the end we'll share some free resources to help you start your own LLC and follow your business dreams millions of new businesses are formed in America every year they are legally structured as one of several choices sole proprietorships general partnerships corporations or limited liability companies the structure chosen for a business will determine who owns the business how taxes are paid and who's liable if a lawsuit or debt arises each state has specific requirements on forming and maintaining a business structure for small business owners and entrepreneurs one of the most beneficial business structures to choose from is the LLC the limited liability company an LLC has several features that make it desirable the first is LLC's acts as a legal entity separate from its owners creating what is known as a corporate veil this protection keeps the owners personal assets secure in the event of a lawsuit or unpaid business debt the second is LLC's that pass through taxation when a corporation makes a profit net profit is taxed distributed to the owners and then taxed again as personal income and LLC's profits are not taxed thus the owners only pay tax on the revenue wants and the third is that business accounting and compliance can be complicated LLC's relative to other corporate structures streamline the formation and record-keeping burden making them easy even for single owner businesses to maintain these are the main reasons you might want to start an LLC for your business there are many other reasons as well for instance privacy which we will address later and the fact that LLC owners do not have to be US citizens or permanent residents if you want flexibility and simplicity LLC's are a great option for starting a new business Oh an LLC protects your personal assets if you operate your business as a sole proprietor a partnership and for example someone gets hurt on your premises or one of your products injures someone you can be sued as an individual and lose your personal assets your home your car etc an LLC protects the business owner by acting as a separate legal entity responsible for its own debts and lawsuits the distinction between owners and business structure is known as the corporate veil it's not enough to simply establish an LLC you'll need to preserve the corporate veil by signing documents as a representative of the company and not as an individual keeping personal and business finances separate following an operating agreement avoiding fraudulent activities and keeping up to date with annual filings you can learn more about the corporate veil at our website and research common forms of business insurance you can never completely prevent problems but to prepare for the worst and protect yourself in your business forming an LLC is a good first step while LLC's are taxed taxes are one of the most complicated parts of owning a business and the penalties are stiff if you fail to comply with the law LLC's are quite flexible on how you choose to be taxed which can be used to your benefit well the details are too much to cover in this video the most important things to know about LLC taxes are if you're a single-member LLC the IRS ignores the business structure in taxes you like at wooden individual the Alice's income is reported on your personal tax return at the end of the year if you have a multi-member LLC the LLC does not pay any income taxes and all profits are passed through to the members who then pay the IRS on their individual tax return well these are the default tax elections you can also opt for your LLC to be taxed as a corporation a C Corp or an S Corp regardless of your tax designation you'll need to file yearly with the IRS check out our federal tax guide or consult with an accountant for specific details on what forms you'll need to file as for state taxes because LLC's are typically pass-through entities individual members pay state taxes not the LLC itself however there are certain types of taxes LLC's may have to pay common forms of state tax you may have to pay include franchise tax sales tax withholding tax and unemployment insurance tax again you'll want to consult an accountant for details the importance of an operating agreement when forming an LLC the most essential document is the operating agreement an operating agreement is an internal document meaning it doesn't need to be filed with the state however it's a critical component of your LLC that outlines the essential ownership and member details of the organization the operating agreement is the foundation of your LLC a living document that gives your business credibility and helps maintain your corporate veil it will outline the management and voting rules capital contributions and distributions membership and dissolution practices and all the basic stipulations on how the companies operated we provide operating agreement templates at our site we also rate and recommend professional LLC services that can help you create a custom operating agreement whose professional corporate agents are secondary companies for hire that can help you form and maintain your LLC which we'll address next using a professional LLC formation service LLC's are formed at the state level and typically cost between 50 and 150 dollars for basic formation to officially form an LLC you'll file paperwork with your state's Secretary of State and once that's been processed you'll register for an EIN or employer identification number with the IRS your ein is like a social security number for your company and is necessary for taxes and banking you can do all this on your own to save money or you can hire a professional service for an additional fifty to one hundred and fifty dollars various providers have different packages but one service to consider is hiring a registered agent when you file your formation documents with the state they'll ask for a registered agent which is like a point of contact to receive mail and official papers an LLC's registered agent can be a member of the LLC or it can be a hired service a hired registered agents of great convenience they'll help you with getting your reports filed on time will keep your business mail separate and will be available at all regular business hours to accept official mail and legal papers on your LLC's behalf final an important additional benefit of using a services privacy a professional service will provide a level of privacy by withholding your personal name and home address from the LLC's contact information there are many reasons you might not want your personal information easily accessible and associated with your busines

Thanks Dana your participation is very much appreciated

- Gary Chapmon

About the author

Gary Chapmon

I've studied archaeoastronomy at Slippery Rock University of Pennsylvania in Slippery Rock and I am an expert in exoplanetology. I usually feel uncomfortable. My previous job was radio & tv talk show host I held this position for 8 years, I love talking about knowledge/word games and racing. Huge fan of Aristotle I practice vault and collect bazooka joe comics.

Try Not to laugh !

Joke resides here...

Tags

How can an LLC avoid taxes

How much can an LLC write off

What can I write off as an LLC

How can an LLC avoid double taxation

Is an LLC a privately owned business

What are 10 small businesses

Why are LLCs so popular

Why do investors look for an LLC company

What are the tax benefits of having an LLC

What is the most common LLC Type

What types of businesses are best suited for LLC

What business type is an LLC for Amazon

What does LLC mean for dummies

Do LLCs pay taxes

What are the 4 main types of businesses

Why an LLC is the best option

How many types of LLC are there

How much does an LLC cost

Is Shopify an LLC

: 2104

: 2104