federal tax returns for llc [Fact-Checked]

Table of Contents

- Does an LLC file a 1065 or 1120?

- What is the best tax structure for LLC?

- Is income from an LLC considered personal income?

- What are tax benefits of an LLC?

- Do I need to pay 800 LLC fee the first year?

- Is LLC fee waived first year?

- Can I write off franchise fees?

- What are the 3 types of LLC?

- Is it better to be self employed or LLC?

- What is the best business entity for tax purposes?

- How can an LLC avoid double taxation?

- Does LLC file own tax return?

- How much business expenses can you write off?

- How do LLC tax returns work?

- How can I avoid $800 franchise tax?

- Which is better for taxes LLC or S Corp?

- Does single-member LLC need to file 1065?

- How can an LLC avoid taxes?

- What can you write off on taxes for LLC?

- Do you have to file taxes your first year in business?

Last updated : Sept 24, 2022

Written by : Gerry Becker |

Current |

Write a comment |

Does an LLC file a 1065 or 1120?

If the LLC is a partnership, normal partnership tax rules will apply to the LLC and it should file a Form 1065, U.S. Return of Partnership Income. Each owner should show their pro-rata share of partnership income, credits and deductions on Schedule K-1 (1065), Partner's Share of Income, Deductions, Credits, etc.

Does LLC file own tax return?

The IRS disregards the LLC entity as being separate and distinct from the owner. Essentially, this means that the LLC typically files the business tax information with your personal tax returns on Schedule C. The profit or loss from your businesses is included with the other income your report on Form 1040.

How do LLC tax returns work?

The IRS treats one-member LLCs as sole proprietorships for tax purposes. This means that the LLC itself does not pay taxes and does not have to file a return with the IRS. As the sole owner of your LLC, you must report all profits (or losses) of the LLC on your 1040 tax return.

How can I avoid $800 franchise tax?

Thus, the only way to avoid the tax is to dissolve the company. Additionally, another important detail to note is that if you change your business structure during the year–for instance, from an LLC to a C corporation–you would then be subject to the minimum franchise tax on both entities for that year.

Which is better for taxes LLC or S Corp?

LLCs. As an LLC owner, you'll incur steep self employment taxes on all net earnings from your business, whereas an S corporation classification would allow you to only pay those taxes on the salary you take from your company. However, itemized deductions could make an LLC a more lucrative choice for tax purposes.

Does single-member LLC need to file 1065?

Note: Single-member LLCs may NOT file a partnership return. Most LLCs with more than one member file a partnership return, Form 1065. If you would rather file as a corporation, Form 8832 must be submitted.

How can an LLC avoid taxes?

An LLC can help you avoid double taxation unless you structure the entity as a corporation for tax purposes. Business expenses. LLC members may take tax deductions for legitimate business expenses, including the cost of forming the LLC, on their personal returns.

What can you write off on taxes for LLC?

- Meals and lodging.

- Deduction limit on meals.

- Food and beverage expense incurred together with entertainment expenses.

- Transportation (commuting) benefits.

- Employee benefit programs.

- Life insurance coverage.

- Welfare benefit funds.

Do you have to file taxes your first year in business?

In the initial year(s) of business, U.S. partnerships do not need to file a federal return if the business hasn't received income or incurred any expenses treated as deductions or credits for federal income tax purposes.

What is the best tax structure for LLC?

As a simple and effective tax structure, many multi-member LLCs will find the partnership tax status to be an ideal choice. However, if your company plans to seek funding from outside investors or other types of passive owners, you may want to consider being taxed as a corporation.

Is income from an LLC considered personal income?

LLC Owners and Self-Employment Tax This income is considered self-employment income and it's subject to self-employment tax (Social Security and Medicare). You must complete Schedule SE to calculate how much you owe, based on your business net income. The total is added to your other income on your personal tax return.

What are tax benefits of an LLC?

The Tax Cuts and Jobs Act (TCJA) added the latest LLC tax benefits. This act allows LLC members to deduct up to 20% of their business income before calculating tax. If you don't choose S corporation tax status for your LLC, members can often avoid higher self-employment and income taxes with this deduction.

Do I need to pay 800 LLC fee the first year?

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

Is LLC fee waived first year?

A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year. Business entities such as LLCs, LLPs, and LPs are subject to an $800 annual tax.

Can I write off franchise fees?

According to the IRS, franchise fees fall under “Section 197 Intangiblesâ€3 and are not tax deductible. However, since the IRS requires you to amortize the franchise fee over 15 years, you can recoup the fee through a depreciation tax deduction every year during that time period.

What are the 3 types of LLC?

- Single-member LLC for the sole-proprietorship (solo entrepreneur)

- Multi-member LLC (member-managed LLC or manager-member LLC)

- Domestic LLC and Foreign LLC.

- Series LLC.

- L3C Company (low-profit LLC)

- Anonymous LLC.

- Restricted LLC.

- PLLC and LLC.

Is it better to be self employed or LLC?

You can't avoid self-employment taxes entirely, but forming a corporation or an LLC could save you thousands of dollars every year. If you form an LLC, people can only sue you for its assets, while your personal assets stay protected. You can have your LLC taxed as an S Corporation to avoid self-employment taxes.

What is the best business entity for tax purposes?

Limited Liability Company (LLCs) LLCs are generally the preferred entity structure for certain professionals and landlords. LLCs have flexibility as the owners can file as a partnership, S Corporation or even sole proprietor since the LLC is really a legal and not tax designation.

How can an LLC avoid double taxation?

Thus, the first way to avoid double taxation is to choose a business entity that is not double taxed. This includes forming a California Corporation and then electing S-Corporation status with the IRS. Many small business owners have nonetheless formed corporations without electing S-Corporation status.

How much business expenses can you write off?

In 2021, you can deduct up to $5,000 in business start-up expenses and another $5,000 in organizational expenses in the year you begin business. Additional expenses must be amortized over 15 years.

Check these related keywords for more interesting articles :

Is a LLC name available

How does an LLC file income taxes

How to become a tax exempt llc

LLC in florida search warrants

Does a period follow llc vs sole

Can a llc be a holding company

Nc LLC operating agreement template free

Where to look up LLC owners

How much does an llc cost in md license verification

American megatrends international llc 519

Close llc bank account

Should i make my podcast an LLC

Advantages of an llc vs sole proprietorship

Can you be your own registered agent for llc

Does a LLC need a ein

Did you find this article relevant to what you were looking for?

Write a comment

Comment by Tamesha Dehmer

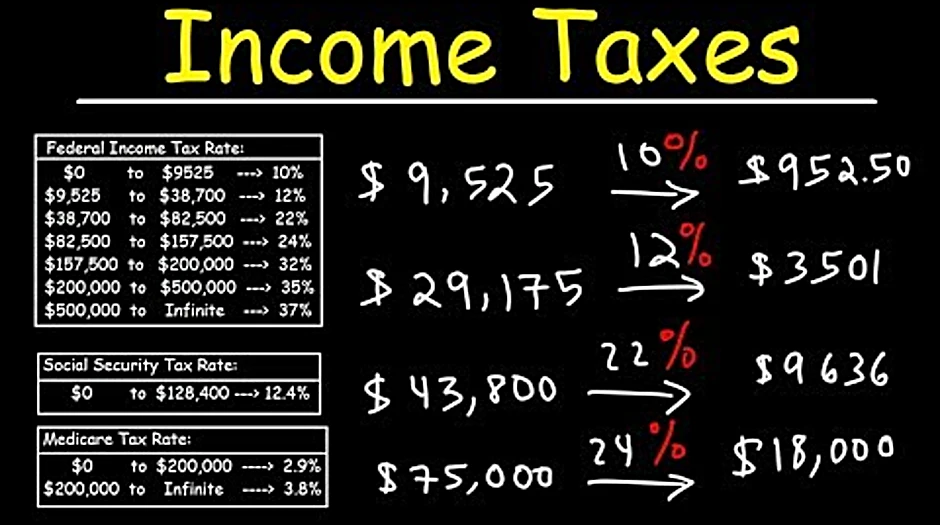

in this video we're going to talk about how to calculate income tax let's start with this example karen's taxable income was 85 000 in 2018. so using the tax income rate table that we see below how much does she pay in federal income taxes in 2018 so what do we need to do the first thing you want to do is look at the first row the first 9525 dollars that she earns she's going to pay 10 percent on that money so what is 10 percent of and twenty five 9525 to calculate ten percent of that multiply that number by point ten you can get point ten by taking ten percent and dividing it by a hundred that's how you convert a percentage into a decimal so it's 95.25 times 0.10 and so she's going to pay 952.50 on this amount but we're not done yet we need to get up to 85 000. now let's move on to the second row what we're going to do is we're going to subtract the higher value minus the lower value so if you take 38 700 and subtract it by 9525 you should get this figure 29 175. now the tax rate for that portion of the income is 12 percent so we're going to do is take that number and multiply it by now twelve divided by a hundred is point twelve and so that's going to give us three thousand five hundred and one dollars now let's move on to the next tax bracket so from thirty eight thousand seven hundred to eighty two thousand five hundred karen's gonna pay 22 percent of that income so let's subtract the higher number by the lower number so 82 500 minus 38 700 that gives us 43 800. so she's going to pay 22 percent on this income and so let's multiply 43 800 by 0.22 and so you should get thirty six 9636. now we need to move on to the next tax bracket the twenty four percent level now her income is eighty five thousand so we're not going to go to one hundred fifty seven thousand five hundred we're going to stop at eighty-five thousand so we're gonna subtract eighty-five thousand by this number eighty-two thousand five hundred eighty-five thousand minus eighty-two thousand five hundred that's 2500 and so she's going to pay 24 of that income so 2500 times 0.24 that's going to give us 600. by the way if you add these values you should get 85 000. so if you add 9525 plus 29 175 plus 43 800 plus 2500 you should get 85 000 just to make sure that you're on the right track now to get the final answer for this problem we need to add up these values that we see here so 952.50 plus 3501 plus 96.36 and then plus 600. so the total amount that she's going to pay in income tax is 14 000 i'm running out of space here 689 dollars and 50 cents so that's how you can calculate the amount of federal income tax that a person has to pay given the tax rate table now let's move on to our next problem john is self-employed he generated a hundred seventy thousand 000 in revenue in 2018 his business expenses for that year was 50 000 what is john's net income for that year so his net income is going to be the difference between his revenue and his business expenses so that's going to be a hundred seventy thousand minus fifty thousand so one seventy 15 i mean 170 minus 50 or you could think of 17 minus 5 you get 12. so this is going to be 120 000. so that's his net income for the year now what about part b if he received 12 000 in tax deductions that is apart from his business expenses how much did he pay in federal income taxes so now we need to calculate his taxable income so his taxable income is going to be the net income which is 120 000 minus the tax deductions of 12 000 and so his taxable income is one hundred and eight thousand dollars so we need to calculate the amount of federal income taxes he's gonna pay on this amount using this table so let's focus on the first row he's going to pay 10 of 9 525 dollars so ten percent of that we know it's nine hundred fifty two dollars and fifty cents now let's move on to the next row let's begin by subtracting thirty eight thousand seven hundred by nine thousand five hundred twenty five and so that's going to give us twenty seven i'll take that back that's uh twenty nine thousand one seventy five and he's going to pay 12 on that portion so let's multiply 29175 by 0.12 or 0.12. so this is the same number that we had before 3501 now let's move on to the third row let's subtract 82 500 by 38 700 and so that's going to be forty three thousand eight hundred and we're going to multiply that by twenty two percent which is point twenty two so that's going to give us nine thousand six hundred thirty six now her taxable income level is in the fourth row so we're gonna take this number a hundred and eight thousand and we're gonna subtract it by this number eighty-two thousand five hundred so a hundred eight thousand minus eighty-two thousand five hundred that's going to be twenty five thousand five hundred dollars and john is going to pay 24 on that portion so he's in a 24 tax bracket so twenty five thousand five hundred times point two four that's six thousand one hundred and twenty so now to calculate his total tax bill we're going to add up everything that we see right here so 952.5 plus 3501 plus 96.36 plus 6120 so his tax bill for the year is twenty thousand two hundred and nine dollars and fifty cents now let's move on to part c how much would he pay in federal income taxes if he received a 12 000 tax credit instead of 12 000 in tax deductions so this is the amount that he would have to pay if he received a tax deduction now this part of the problem it's really going to show the effect of having a tax credit over a tax deduction we need to understand is that the tax deduction reduces the taxable income whereas the tax credit it reduces your tax bill so with the tax deduction the taxable income was a hundred and eight thousand dollars with the tax credit we need to recalculate the taxes the taxable income is now 120 000. so we're going to have to calculate our tax bill based on this number and not the 100 8 000. so let's start from the beginning we know that john's gonna pay ten percent on the first nine thousand five hundred twenty five dollars that he earns so that's gonna be 952 and 50 cents and then subtracting these two numbers 38 700 by 95 25. so we know he's going to pay 12 on this portion which is 3501 and then subtracting these two numbers which is forty three thousand eight hundred he's going to pay 22 percent of that so 43 800 times 0.22 that's 96 36 now this part is where it's going to be different we're going to subtract 120 000 by 82 500 and so that's going to give us 37 hundred and he's going to pay twenty four percent of that so multiply thirty seven five hundred by point two four and that's going to give you nine thousand now let's go ahead and add these numbers let's calculate the tax bill before a tax credit is applied so we have 950 250 plus 3501 plus 96.36 plus nine thousand so right now his tax bill without the twelve thousand in tax deductions is twenty three thousand eighty nine dollars and fifty cents so this is his tax bill without any tax deductions applied to it or any tax credits so with a 12 000 tax deduction notice that his tax bill reduced almost just under three thousand dollars that's how much it decrease

Thanks for your comment Tamesha Dehmer, have a nice day.

- Gerry Becker, Staff Member

Comment by der88dR

okay how to file your taxes as an llc owner let's discuss it now in order to do this we have to break this video down into two sections because you have the single member llc and then you have the multi-member llc and although they are both limited liability companies or llcs the tax returns are prepared and filed a little bit differently and i want to make sure that you are filing your taxes correctly in 2022 so today i'll be going over what tax returns you need to file as an llc owner what you need to record and what you need to put in your tax return how to pay your current and future taxes and any tips and faqs along the way so you stay out of trouble with the irs so if all that sounds good to you make sure you like this video while the intro plays hey there and welcome to our channel i'm sean with life accounting the accounting firm that is dedicated to helping you save on taxes and building more wealth and also i want to say thank you to everyone who has been subscribing and joining our channel we really appreciate the support and it gives us the positive reinforcement to continue making youtube videos alright so step number one what tax return do you need to file as an llc owner well as i mentioned it depends on what type of llc you have let's go over all three so you have a single member llc which means you are the sole owner of your limited liability company and you have no partners that means you will need to file your taxes using forms schedule c and schedule se and that can be found on the us 1040 the individual income tax return now the schedule c portion is used to report the income and expenses you incurred as a part of your business schedule se is also required to be included with your tax return as a single member llc because it is used to calculate your self-employment tax liability and schedule se stands for self-employment now i'll break down exactly what goes on as schedule c in just a second but before we do let's talk about the multi-member llc now if you have a multi-member llc that means you have at least one other partner in your business so there are at least two llc members if that's you then what you guys need to do is file u.s form 1065 the partnership return of income okay this form allows you to clearly allocate the portion of income and losses to each partner hey sean look i can split my profits with myself okay kind of like that now this form must be filed by the business tax deadline which is usually march 15th now there are about three pages on the 1065 forum which covers all your income and expenses as well now lastly if you have an llc regardless of if it is a single member llc or a multi-member llc and you have elected to be taxed as an s-corporation which by the way being taxed as an s-corporation allows you to eliminate some of the self-employment tax which is great for businesses who are making at least seventy thousand dollars in net income anyway llcs who have been elected to be taxed as an s corporation need to file us form 1120s the income return for s corporations and this form mainly ensures that owner employees are paying themselves a reasonable salary and calculate the distributions earned from the company this tax return also must be filed by the business tax deadline which is usually march 15th now llc partnerships in s corporations still need to file a normal 1040 form for their individual tax purposes as well alright so now that you know which tax forms you need to file let's move into number two what you need to record on your tax return now the tax code and the irs are very simple okay they want to know who you are and they want to know what integrity might i add how much money you made and what percentage of that should be allocated towards your taxes and that's the case for every business regardless of which tax return you need to file which by the way if you need professional assistance with tax planning and tax preparation then consider working with our team there will be a link in the description below where you can sign up for more information so the next step step number two for every llc owner is to record information about you and your business on your tax return you're gonna need to record stuff like your business name your business address your business ein number your principal business or profession like what you sell your principal business code or activity code your accounting method if you materially participated in the operations of the business if you just started or acquired the business and if you needed to file any 1099 forms as well as any other important information about your business the irs will ask you additional questions so they know everything there is to know after that then you can move into step number three and look at the next section on the schedule c general partnership form an 1120s tax form which is income reporting in this section the irs wants to figure out what your gross income was for your business now you may receive one or multiple 1099 miscellaneous forms or 1099 net forms to report exactly how much income you made and if you had a lot of online sales then you may also receive a 1099k form to report your income with as well hey sean look i'm reporting all my income forms okay kind of like that now once you have all your income reported then it's time to move on to step number three record your qualified business expenses now most platforms and companies make it pretty easy to find out what your gross income was for the year but expenses well not so much okay it's up to you to make sure you are tracking or bookkeeping all your expenses throughout the tax year now once you have all your expenses and transactions categorized and organized then you can move on to step number four and start recording your expenses on your tax return okay you're going to want to record any asset purchases that you made throughout the tax year any direct qualified expenses you spent money on such as advertising fees meals employee benefits etc and if you had cost of goods so you want to make sure you complete that section as well as well as any vehicle expenses you may have incurred as well now once you have listed all your qualified expenses or tax deductions or tax write-offs then you will arrive at your net income which will determine your total taxable income what tax bracket you fall into and what taxes you need to pay if you haven't already done so and all of that is calculated pretty quickly when you file on the 1040 form with a schedule c after that then you can move into step number five which is to go ahead and record any other individual activity on your tax return and then file your taxes however if you completed step number four within a 1065 partnership tax return or an 1120s tax return then step number five is for you to obtain your k1 document okay this k1 document is used to distribute each partnership share of current income deductions credits and other special items on their tax return so basically you need to file your 1065 or your 1120s again by the business tax deadline which is usually march 15 and then file your k1 document on your

Thanks der88dR your participation is very much appreciated

- Gerry Becker

About the author

Gerry Becker

I've studied limacology at Notre Dame College in Cleveland and I am an expert in sociology of markets. I usually feel ecstatic. My previous job was chemical plant operator I held this position for 13 years, I love talking about butterfly watching and skateboarding. Huge fan of Yung Gravy I practice shuffleboard and collect handbags.

Try Not to laugh !

Joke resides here...

Tags

What is the best tax structure for LLC

Is income from an LLC considered personal income

What are tax benefits of an LLC

Do I need to pay 800 LLC fee the first year

Is LLC fee waived first year

Can I write off franchise fees

What are the 3 types of LLC

Is it better to be self employed or LLC

What is the best business entity for tax purposes

How can an LLC avoid double taxation

Does LLC file own tax return

How much business expenses can you write off

How do LLC tax returns work

How can I avoid $800 franchise tax

Which is better for taxes LLC or S Corp

Does single-member LLC need to file 1065

How can an LLC avoid taxes

What can you write off on taxes for LLC

Do you have to file taxes your first year in business

: 7285

: 7285