how much does an llc cost in mdcs [Expert Advice]

Table of Contents

Last updated : Sept 8, 2022

Written by : Pete Crocco |

Current |

Write a comment |

Did you find this article relevant to what you were looking for?

Write a comment

Comment by Edgar Camilo

hi guys welcome to the simplify llc channel in this video we're going to explain how much it costs to start an llc in illinois this state is great for entrepreneurs who don't want to spend too much but it also has some nice add-ons depending on your business's needs if you're new to the channel don't forget to hit the like button and press the bell icon to subscribe and be notified when we publish a new video alright let's get started if you're planning to do business in illinois you'll need to register your llc in this state so you're likely trying to plan the cost good news you can get away with forming an llc in illinois for as little as 150 the basic cost is for your articles of organization and that's the same for both domestic and foreign llcs in illinois you pay the formation fee to the secretary of state in most cases this is all you need to establish your llc in illinois simply submit form llc 5.5 and pay the 150 and you should be in business literally in about 10 business days need to move more quickly illinois allows you to expedite your filing at the chicago and springfield offices for just 100 more and you'll get results within 24 hours as with any llc you'll need a registered agent that might be you if you reside in illinois or a designated person for your foreign llc either way choosing a registered agent is included in your articles of incorporation but here's where it gets tricky if you need to inform the secretary of state that your registered agent has resigned it's five dollars now that's not too bad but it costs 25 dollars to change your registered agent and if you don't report a resignation within 60 days you'll be hit with a 100 late fee so select the right person for the role and be sure to alert the state asap of any changes so now that you know the budget let's see about registering your business's name in many states it can be a race to get your documents in order so you can claim your name but illinois has a nice feature if you have that perfect name in mind but your articles of incorporation aren't ready you can reserve it with the state for just 25 which is a fair price for the convenience of a little extra time now what if your llc includes a sub brand or you'd like to use a different name for your illinois llc well you'll need to request a dva name dba is short for doing business as and it's essentially a registered alias for your illinois llc many states charge a flat fee for a dba but in illinois it's a bit different if you file the dba in a year ending in zero or five your fee is 150 in addition to the hundred and fifty dollars for the articles of incorporation if you file it during a year ending in one or six it's a hundred and twenty dollars two or seven it's ninety dollars three or eight it's sixty dollars and if the year ends in four or nine it's just 30 to register a dpa the idea is to spread out your costs over a five-year period so if it's not urgent to register your dba in illinois wait for a year that ends in four or nine just remember you'll need to renew your dba every five years and be sure to do it at least 60 days before it expires or the state will fine you one hundred dollars but wait that's not all you must stick with your dba name during that five years or else it's 25 to change it once your business is up and running you'll need to file an annual report which carries a filing fee of just 75 this is due on the first day of the month following your registration anniversary so if you registered on august 15th your annual report due date is september 1st be sure to get it on time because as with all other parts of illinois llcs the late fee is 100 and that's it illinois is overall quite affordable to register and maintain an llc as long as you time it right and hit your deadlines this state also has no minimal annual franchise taxes although you do have personal income taxes overall though it's fairly simple to register your llc in illinois and there are some nice benefits for entrepreneurs who want to expedite the process or get first dibs on a name well that's it for today thanks for watching if you want to know more about what an llc is its benefits and disadvantages you'll find the link to those videos in the description box below also don't forget to like and subscribe feel free to write in the comments if you have any further questions and we will see you next time

Thanks for your comment Edgar Camilo, have a nice day.

- Pete Crocco, Staff Member

Comment by Demetra

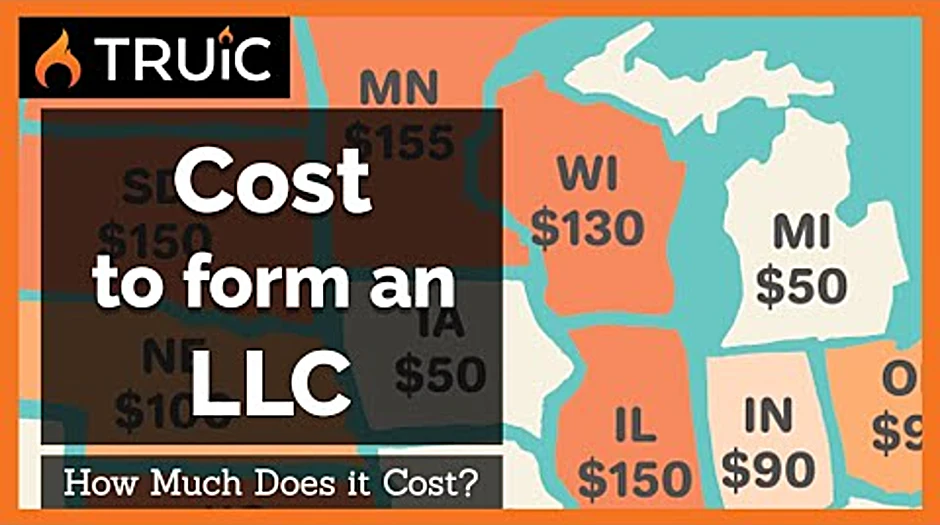

the process of forming an LLC is different in every state and the costs are different as well in this video we will give you a general overview of the fees you will need to pay when you start an LLC as well as those you need to pay to maintain it over time we will also address fees that you do not have to pay to form an LLC so make sure to watch to the end to save some money forming an LLC requires you to pay a one-time state filing fee in addition to ongoing annual maintenance fees first let's take a look at one time filing fees the main cost when forming an LLC is typically the fee of filing your articles of organization with the state this one-time payment ranges between 40 and 500 dollars depending on your state visit our site to determine the exact filing costs for your particular state several states Arizona Nebraska and New York also require your newly incorporated LLC to publish a statement of formation in a local newspaper these publishing costs can be anywhere from forty to two thousand dollars depending on your state specific requirements visit our site for strategies to publish in your state as cheaply as possible in addition to the initial formation fees there are regular maintenance fees that you'll need to pay to keep your LLC in good standing let's take a look at these now annual biennial report most states require LLC's to submit a fee along with an annual or biennial report which includes updating the name and address with the LLC the report fee varies state by state but in most cases is less than $50 per year some states levy a yearly tax on LLC's often call the franchise tax this is most often a flat tax but can also vary accordingly to your LLC's annual earnings in certain states for instance California LLC's must pay a yearly $800 franchise tax if they make less than 250 thousand dollars and more if they earn more than 250 thousand dollars to calculate the specific costs of maintaining an LLC in your state visit our website for an additional cost of 50 to 150 dollars you can use the professional formation service to create your LLC this can save you both time and the headache of filling out legal paperwork various service providers have different packages which generally charge for LLC formation registered agent service creating your LLC's operating agreement obtaining an employer identification number E I n from the IRS researching which business licenses your LLC will need you may not want all of these services so shop around for different providers and packages you can also visit our site for reviews of the top five formation services the value of a hired professional service goes beyond the convenience however using a service for your registered agent means that they are the first point of contact for all inquiries allowing for an enhanced level of personal privacy of course you should be mindful of certain aspects of LLC formation that are either free or unnecessary if you are looking to save money you can avoid the following research your LLC's name a service may offer this but you can perform a name search for free on your state's website LLC kitten seal these types of fancy documentation are a vanity product and unnecessary from a legal standpoint yah n if forming an LLC on your own you can get your employer identification number for free from the IRS visit our site how to start an LLC com to get all the specific details regarding the costs of setting up an LLC in your state not only do we gather all the essential information in one place we also offer other free resources and tools for getting your business up and running check out the links in the description below and please give us a like and subscribe if you appreciate our content we are dedicated to providing the most useful information for small business owners and would love to see your feedback in the comments on what other information you need to help follow your entrepreneurial dreams you

Thanks Demetra your participation is very much appreciated

- Pete Crocco

About the author

Pete Crocco

I've studied newtonian dynamics at Radford University in Radford and I am an expert in cell biology (outline). I usually feel groggy. My previous job was developmental psychologist I held this position for 16 years, I love talking about carrier pigeons and making crafts. Huge fan of Chuck Palahniuk I practice paintball and collect coca-cola.

: 8092

: 8092