Tax free merger LLC operating [No Fluff]

Table of Contents

- What is a tax free merger?

- Can you merge 2 LLCs?

- Can you merge an LLC with an S Corp?

- What is a mandatory cash merger?

- What three conditions must be met for a completely tax free incorporation?

- Is a statutory merger tax free?

- What is purchase accounting for mergers?

- Can I use my old EIN number for a new business?

- Can I use an existing EIN for a new LLC?

- How do you notify the IRS of a change of ownership of a single member LLC?

- What is the benefit of an F reorganization?

- What are the tax consequences of a taxable merger?

- What are the requirements for an F reorganization?

- How do I report a merger on my taxes?

- What determines if an acquisition is taxable or tax free?

- What happens to Ein in merger?

- Can an LLC do an F reorganization?

- Is cash received in a merger taxable?

- What are the tax benefits available for mergers and acquisitions?

- How do you calculate cost basis for a merger?

Last updated : Sept 8, 2022

Written by : Cruz Wellner |

Current |

Write a comment |

What is a tax free merger?

Summary. A type A Reorganization is a tax-free merger or consolidation. Generally, in a merger, one corporation (the acquiring corporation) acquires the assets and assumes the liabilities of another corporation (the target corporation) in exchange for its stock.

What are the tax consequences of a taxable merger?

Taxable mergers constitute those mergers on which one or both parties involved pay taxes. When companies merge, they pay taxes on the value of the capital, stock or assets acquired during the process of a merger, not on the merger itself.

How do I report a merger on my taxes?

This is done by attaching IRS Form 8594, “Asset Acquisition Statement,†to each of their respective federal income tax returns for the tax year that includes the transaction. If you buy business assets in an M&A transaction, you must allocate the total purchase price to the specific assets that are acquired.

What determines if an acquisition is taxable or tax free?

Acquisitions and divestitures are generally only taxable events for corporations and/or shareholders that receive cash. Under IRC §1032(a), a stock-for-stock exchange is a tax-deferred.

What happens to Ein in merger?

If 2 existing entities merge, the employer identification number (EIN) of the surviving entity is used. If the merger is a change of place of organization the original entity EIN is used and the new corporation does not obtain a new number.

Can an LLC do an F reorganization?

A company might also undergo an F reorganization, convert from an S corporation to a single member LLC, and then contribute the single member LLC interest to a new C corporation.

Is cash received in a merger taxable?

If your cost basis is less than or equal to the acquiring company's stock received, any cash or property received in addition to the stock is taxed as a gain.

What are the tax benefits available for mergers and acquisitions?

Tax advantages can also arise in an acquisition when a target firm carries assets on its books with basis, for tax purposes, below their market value. These assets could be more valuable, for tax purposes, if they were owned by another corporation that could increase their tax basis following the acquisition.

How do you calculate cost basis for a merger?

Determine the total number of shares purchased originally and the total purchase price. For instance, if you purchase 100 shares at a cost of $50 per share before the merger, the cost basis is 100 shares at $50 a share for a total investment of $500.

Can you merge 2 LLCs?

An LLC must go through a state agency to merge with another LLC. Once the merger takes effect, one of the LLCs ceases to exist. Property previously owned by each LLC vests in the surviving LLC, and the financial obligations of both LLCs become the obligations of the surviving LLC.

Can you merge an LLC with an S Corp?

Merger Route In most instances, you may register with the secretary of state where you will register the entity. Many states also offer online registration. You may then merge your S corp with the new LLC. Such a merger may require the services of an attorney or business broker.

What is a mandatory cash merger?

In mergers and acquisitions, a mandatory offer, also called a mandatory bid in some jurisdictions, is an offer made by one company (the "acquiring company" or "bidder") to purchase some or all outstanding shares of another company (the "target"), as required by securities laws and regulations or stock exchange rules ...

What three conditions must be met for a completely tax free incorporation?

In addition, a tax-free reorganization generally must also satisfy the three judicial requirements (continuity of interest, continuity of business enterprise, and business purpose) that apply to all tax-free reorganizations.

Is a statutory merger tax free?

In a statutory merger, target shareholders exchange their shares for acquirer stock and up to 60% boot (continuity of interest requirement applies). Boot is immediately taxable to target shareholders, while payment in acquirer stock is tax-deferred.

What is purchase accounting for mergers?

Purchase acquisition accounting strengthens the concept of fair market value at the time of a merger or acquisition. The purchase acquisition accounting approach requires that all assets and liabilities, tangible and intangible, be measured at fair market value.

Can I use my old EIN number for a new business?

Once an EIN has been assigned to a business entity, it becomes the permanent Federal taxpayer identification number for that entity. Regardless of whether the EIN is ever used to file Federal tax returns, the EIN is never reused or reassigned to another business entity.

Can I use an existing EIN for a new LLC?

Typically, if there has been a change in business structure or ownership, you can't transfer an EIN to a new owner. So, you will need to obtain a new EIN.

How do you notify the IRS of a change of ownership of a single member LLC?

To make the change to a single member LLC, the Form 8832 is completed and submitted to the IRS.

What is the benefit of an F reorganization?

F reorganizations are typically used to effectuate a tax-free shift of a single operating company. They are frequently used as part of a pre-sale strategy or for changing certain undesired attributes of an operating company.

What are the requirements for an F reorganization?

- Transferor Corporation's stock is exchanged for the stock of Resulting Corporation.

- Stock ownership identity.

- Resulting Corporation's existing assets or attributes.

- Liquidation of the Transferor Corporation.

- The only acquirer is the Resulting Corporation.

Check these related keywords for more interesting articles :

LLC massachusetts application

North carolina LLC fees

Can an llc be owned by an irrevocable trust

LLC price nyc subway schedule trains

What do you need to create a LLC

What does a registered agent for an LLC do i need articles

LLC cost for each state the angle

What do i need to start an LLC in alabama secretary

Getting an ein number for llc

LLC will be taxed as a partnership

How do i file an LLC online in pa

Best state for ecommerce llc

Does an llc have ordinary share capital

How to dissolve llc in louisiana

Forming llc in delaware

Did you find this article relevant to what you were looking for?

Write a comment

Comment by Ed Strimel

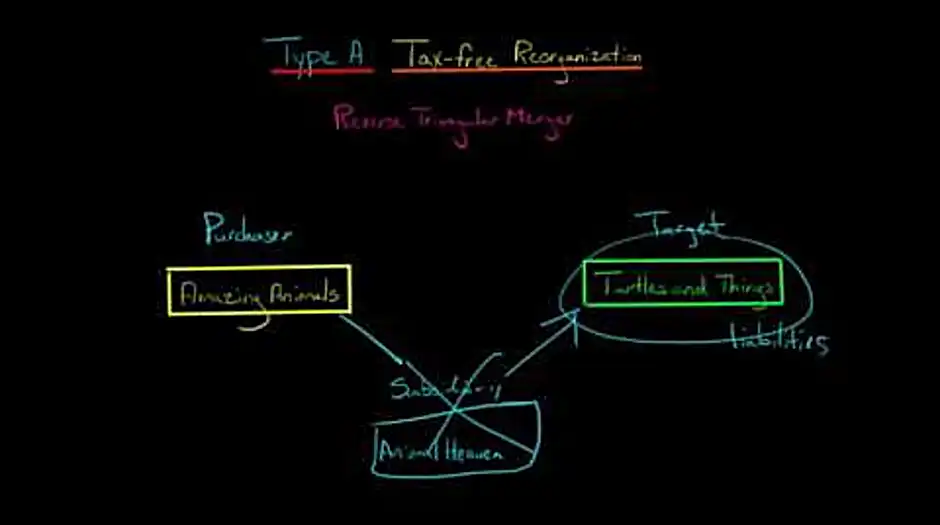

in this video we're gonna talk about a specific type of type a tax-free reorganization and that is the forward triangular merger so let's say that you're the director of a corporation called amazing animals and let's say that you you have a retirement home for animals and you decide that you want to acquire another firm called turtles and things which is a retirement home just for turtles and so you want to acquire this company so you are the purchasing corporation you're the purchaser and turtles and things is going to be the target now if we were just to do a regular type a merger you could just have where turtles and things just merges directly into amazing animals but one of the things is that you're going to get all the liabilities of turtles and things and maybe they have some environmental liabilities or something like that some contingent liabilities that you're not aware of you don't want any part of that and so now there's this new option this forward triangular merger and what you can do is you can either create a subsidiary so so let's say we've got down here this subsidiary we'll call it animal heaven so animal heaven this could either be an existing subsidiary of amazing animals or you could create it specifically for this purpose for this this merger and what you're gonna do now animal heaven is the subsidiary says we're going to call this the sub this is a subsidiary of amazing animals and what's going to happen is that turtles and things turtles and things is actually going to merge into animal heaven not into amazing animals so amazing animals is still the purchaser and turtles and things is still the target it's just that you have this third group now this subsidiary and instead of turtles and things merging into amazing animals its merging into amazing animals subsidiary which is animal heaven and so this is why they call it a triangular merger because here you see that we have kind of a triangle shape now there are some requirements for a four it forward triangular merger first of which is that basically this merger must have qualified is a regular type a merger had the target which in this case is turtles and things had Charles and things merge directly into amazing animals so if it didn't meet the requirements to merge into amazing animals directly then it's not going to qualify as a forward triangular merger now they're also some specific requirements related to four triangular mergers that didn't apply to a regular type a merger and that is the basis so the purchaser in this case which is amazing animals remember amazing animals even though it's got this sub that turtles and things is merging into amazing animals is still the purchaser here okay so the purchaser amazing animals must acquire substantially all of the targets assets okay and that's it it's gonna be what do you mean by substantially all well 70% of the gross assets of turtles and things and 90% of the net assets so we have that requirement that's actually similar to a type C if you if you watch a video that I have on that and now an additional requirement though is that the subsidiary stock so now we're talking and I know it's a little confusing hang in there the subsidiary animal heaven their stock cannot be used as consideration right so when the purchaser when amazing animals is buying turtles and things even though turtles and things is merging into animal heaven if animal heaven has any stock of its own death stock cannot be used to be given to the target in this to make the deal go down right it has to be purchase or stock amazing animal stock that is being given to turtles and things okay so that now there's a little bit of flexibility here in terms of you although stock of animal heaven of this subsidiary cannot be given to turtles and things you could have debt for example or something something like that so there are other things that animal heaven could feasibly complete contribute now remember the main advantage of doing this for triangular merger is that the purchaser is not going to receive the target's liabilities and the reason is is that the subsidiary is going to be getting to the liabilities so right so turtles and things is merging into animal heaven into the subsidiary not into amazing animals so any kind of contingent liabilities things are going to be taken by animal heaven not by amazing animals and that's why this is a popular type of reorganization with many corporations

Thanks for your comment Ed Strimel, have a nice day.

- Cruz Wellner, Staff Member

Comment by Phyllis

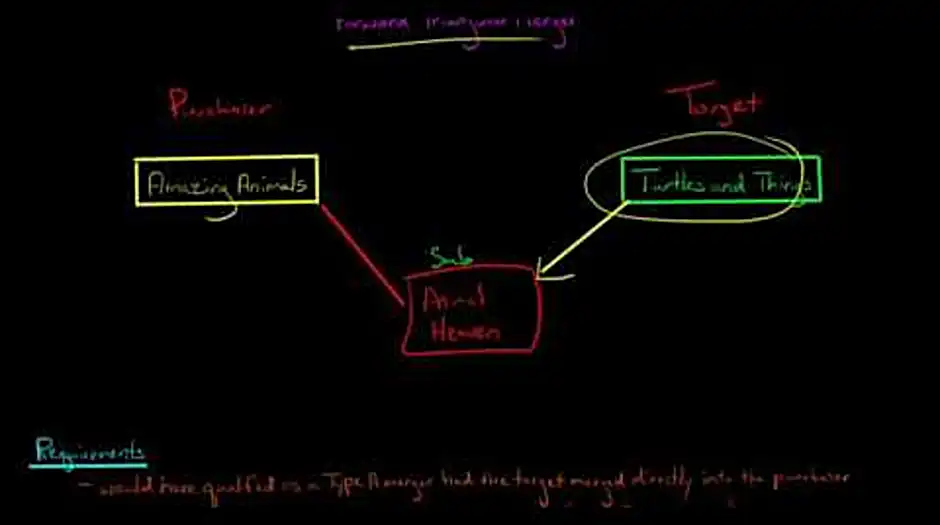

in this video we're going to talk about the reverse triangular merger which is a type a tax-free reorganization so let's say that you're the director of a corporation called amazing animals that runs retirement homes for animals and you decide that you want to acquire another firm called turtles and things that want runs a retirement home specifically for turtles and snakes and so forth so you want to acquire this this company but maybe they have a lot of liabilities or contingent liabilities that you don't want any part of is you don't want them to be part of your organization so what you do is you say okay well I've got an idea you've got a subsidiary so you've got a subsidiary and this is a subsidiary of amazing animals let's say that the subsidiary is called animal heaven so you have the subsidiary and you can create the sub city or if it's an existing subsidiary doesn't matter you have this subsidiary and what you're gonna do is you're gonna acquire Turtles and things that is amazing animals is the purchaser turtles and things is the target however it's not just going to be like a regular type a merger where turtles and things merges directly into amazing animals instead how it's gonna work is actually the subsidiary which again is a subsidiary of amazing animals is actually going to merge in two turtles and things right so the the subsidiary of amazing animals this animal heaven is going to merge into turtles and things okay so again now even though it's it's taking place this way and this is why it's called a triangular merger if you see here the triangle shape still it's going to be the case that amazing animals is still the purchasing Corporation there's still the purchaser and turtles and things are the target and what it is is so now ultimately this subsidiary is going to disappear because it's merging into turtles and things and so the subsidiary is going to disappear and then you'll just have this company and then this company and so basically the liabilities any kind of unknown liabilities or whatever would remain with Turtles and things and they wouldn't become part of amazing animals so if you were to do for example just regular taipei merger where turtles and things went directly into amazing animals and amazing animals got stuck with any liabilities so let me give you a quick little rundown of some of the requirements for a reverse triangular merger now so number one is that basically if this would have qualified as a type a merger had Turtles and things merged directly into amazing animals then you're okay on that requirement so basically all the things that you can think about with a regular type a merger are going to apply although there are a couple couple of additional things so one is that the purchaser in this case again remember the purchaser is amazing animals must acquire substantially all of the targets assets and you say well what does that mean it means a little something if you've already watched a video on forward triangular they have that same requirement but it means a little something different with the reverse triangular merger so what it means where the reverse triangular merger is is essentially two things so after the merger is complete after the subsidiary has been merged into Turtles and things the target which is Turtles and things must hold substantially all of its own properties right so all of its own properties it must still have after the merger and if we were to look at jointly the target and the sub Series properties turtles and things after the merger must hold substantially all of the assets of both of them right and so that's that's a little bit different than with the forward triangular merger now in addition there's there's this a big difference between just a regular type a merger or a forward triangular is that with a reverse triangular at least 80 percent of the consideration being given and again it's the purchaser who is ultimately giving consideration and so forth so at least 80 percent of that consideration must be voting stock of the purchaser if you remember whether just a regular type a merger it would be at least you know forty percent would have to be stock from the purchaser in this case amazing animals but with this reverse triangular merger it has to be at least 80 percent of the consideration and that's again the consideration is what amazing animals it is ultimately being given to the target in exchange for the deal to go through so at least 80 percent of that has to be voting stock from amazing animals so again these types of these triangular mergers whether before word triangular or reverse triangular they become real popular because again they're any unknown liabilities or anything with the target are not going to become part of the purchaser right and in this case but since the subsidiary is merging directly into the target and the subsidiary ceases to exist so basically turtle on things is just going to this is going to retain those liabilities they're not going to be transferred to amazing animals

Thanks Phyllis your participation is very much appreciated

- Cruz Wellner

About the author

Cruz Wellner

I've studied north american history at Central Methodist University in Fayette and I am an expert in christian theology (outline). I usually feel mischievous. My previous job was geography professor I held this position for 7 years, I love talking about reading and jujitsu. Huge fan of Patrick Swayze I practice fishing and collect casino chips.

Try Not to laugh !

Joke resides here...

Tags

Can you merge 2 LLCs

Can you merge an LLC with an S Corp

What is a mandatory cash merger

What three conditions must be met for a completely tax free incorporation

Is a statutory merger tax free

What is purchase accounting for mergers

Can I use my old EIN number for a new business

Can I use an existing EIN for a new LLC

How do you notify the IRS of a change of ownership of a single member LLC

What is the benefit of an F reorganization

What are the tax consequences of a taxable merger

What are the requirements for an F reorganization

How do I report a merger on my taxes

What determines if an acquisition is taxable or tax free

What happens to Ein in merger

Can an LLC do an F reorganization

Is cash received in a merger taxable

What are the tax benefits available for mergers and acquisitions

How do you calculate cost basis for a merger

: 4762

: 4762