What which LLC get 1099 from opm [FAQs]

Table of Contents

- When a taxpayer receives Form 1099-R with no amount entered box 2a and Code 7 entered in box 7 the entire distribution?

- What part of my OPM annuity is taxable?

- What is Box 5 on OPM 1099-R?

- What is the taxable amount on a 1099-R?

- Can I view my 1099-R online?

- What do I do if I don't receive my 1099?

- How do I know if my 1099 was issued?

- Does the IRS audit 1099s?

- Will the IRS let me know if I made a mistake?

- What happens if I don't report my 1099 NEC?

- Who gets Form 1099?

- Who produces 1099-R?

- How does the IRS find out about unreported income?

- Why does my 1099-R Say unknown in box 2a?

- How do I get my 1099-R?

- Will the IRS catch a missing 1099-R?

- Can I file my taxes without my 1099-R?

- How do I get my 1099-R from OPM?

- What is the penalty for not filing a 1099-R?

- When should I receive 1099-R?

Last updated : Sept 15, 2022

Written by : Shawanna Mcbath |

Current |

Write a comment |

When a taxpayer receives Form 1099-R with no amount entered box 2a and Code 7 entered in box 7 the entire distribution?

When a taxpayer receives form 1099R with no amount entered in box 2a and a 7 in box 7 the entire distribution is handled how? The full amount in box 1 is taxable, unless YOU know some reason it isn't; which you will tell TurboTax in the interview following entering the 1099-R.

Who produces 1099-R?

The form is provided by the plan issuer, who must give a copy to the IRS, the recipient of the distribution, and the recipient's state, city, or local tax department. As with other IRS forms, the 1099-R form should also include the payer's name, address, telephone number, and taxpayer identification number (TIN).

Why does my 1099-R Say unknown in box 2a?

What does that mean? If your 1099R Statement Box 2. a for the Taxable Amount is marked as 'Unknown'; this means that OPM did not calculate the tax-free portion of your annuity.

How do I get my 1099-R?

You can access it by signing in to your retirement account and then selecting the 1099-R link from the main menu. From there, you can view it or print a copy. Hard copies of the form will be mailed by the end of January.

Will the IRS catch a missing 1099-R?

Chances are high that the IRS will catch a missing 1099 form. Using their matching system, the IRS can easily detect any errors in your returns. After all, they also receive a copy of your 1099 form, so they know exactly how much you need to pay in taxes.

Can I file my taxes without my 1099-R?

If you cannot get a copy of your W-2 or 1099, you can still file taxes by filling out Form 4852, “Substitute for Form W-2, Wage and Tax Statement.†This form requests information about your wages and taxes that were withheld. It may be helpful to have documentation, such as a final pay stub, available to complete it.

How do I get my 1099-R from OPM?

- Sign in to your online account. Go to OPM Retirement Services Online.

- Click 1099-R Tax Form in the menu to view your most recent tax form.

- Select a year from the dropdown menu to view tax forms from other years.

- Click the save or print icon to download or print your tax form.

What is the penalty for not filing a 1099-R?

If a business fails to issue a form by the 1099-NEC or 1099-MISC deadline, the penalty varies from $50 to $270 per form, depending on how long past the deadline the business issues the form. There is a $556,500 maximum in fines per year for small businesses.

When should I receive 1099-R?

The IRS requires PAi to send a Form 1099-R by January 31st of the year following any 401(k) distribution amount of $10 or more.

What part of my OPM annuity is taxable?

These benefits are paid primarily under the Civil Service Retirement System (CSRS) or the Federal Employees' Retirement System (FERS). Tax rules for annuity benefits. Part of the annuity benefits you receive is a tax-free recovery of your contributions to the CSRS or FERS. The rest of your benefits are taxable.

What is Box 5 on OPM 1099-R?

Box 5, Employee contributions/Designated Roth contributions or insurance premiums: This is the portion of after-tax money you are entitled to exclude from your Gross Distribution (in Box 1) for the calendar year.

What is the taxable amount on a 1099-R?

Box 2a - Taxable Amount shows the portion of the distribution that is generally taxable. If there is no entry in this box, the payer wasn't able to determine the taxable amount and it will have to be determined by the taxpayer. When this occurs, the first box in Box 2b should be checked.

Can I view my 1099-R online?

1099-R tax forms are mailed by the end of January each year. If you recently moved, be sure to update your mailing address. You can access and download your tax statements online by logging in to myCalPERS. To request a duplicate or replacement 1099-R tax form by mail, contact us.

What do I do if I don't receive my 1099?

If you have not received an expected 1099 by a few days after that, contact the payer. If you still do not get the form by February 15, call the IRS for help at 1-800- 829-1040. In some cases, you may obtain the information that would be on the 1099 from other sources.

How do I know if my 1099 was issued?

If you are looking for 1099s from earlier years, you can contact the IRS and order a “wage and income transcriptâ€. The transcript should include all of the income that you had as long as it was reported to the IRS. All you need to do is fill out a Form 4506-T and mail or fax it off to the IRS.

Does the IRS audit 1099s?

The IRS has years to audit your tax return Even if this automatic system doesn't catch your unreported 1099 income, the IRS can always go back and check it by hand.

Will the IRS let me know if I made a mistake?

If the IRS finds a mistake, you will likely receive a letter in the mail notifying you of it. You may face an audit if, however, your mistake is more serious, such as underreporting income. Audits usually begin with a letter asking for more information. The IRS does not catch every mistake on a tax return.

What happens if I don't report my 1099 NEC?

Find out more about 1099 filing penalties here. The late filing penalty is $50 per form if you file within the 30 days of the due date. If you file after 30 days, but before August 1 of the filing year, the penalty is $110 per form. If you file after that or do not file at all, then the penalty is $280 per form.

Who gets Form 1099?

Businesses are required to issue a 1099 form to a taxpayer (other than a corporation) who has received at least $600 or more in non-employment income during the tax year. For example, a taxpayer might receive a 1099 form if they received dividends, which are cash payments paid to investors for owning a company's stock.

How does the IRS find out about unreported income?

When the IRS needs more information or does not have any information about your income, they get it from the IRP. If a taxpayer underreports income, i.e. the income figure they reported on their tax return is less than their actual income, the IRP sends an alert to the IRS.

Check these related keywords for more interesting articles :

What is a springing member of an LLC

Michigan LLC renewal cost

LLC formation services texas

Am i a member or manager of my llc

California llc tax first year exemption in spanish

Cheapest way to set up llc

Who owns an LLC in ky state board

Convert llc to s corp tax consequences

Form llc online reviews

Can i open an llc in texas with an itin

Should i get an LLC for airbnb

LLC formation service texas

Best banks for LLC accounts

Should LLC have different address in philippines wood

When were LLCs created synonym verb

Did you find this article relevant to what you were looking for?

Write a comment

Comment by Kristi Maltbia

five benefits of incorporating an LLC in the United States of America over the last two years there have been a lot of changes in your offshore world compliance regulations have become higher economic substance regulations have reintroduced and many restrictions it's really difficult now to get bank accounts even for legit business operations so many people have started to move from their offshore business into their own - like other jurisdictions and the United States over the last year has really emerged as a prime location for online entrepreneurs all over the world here are the benefits for you of incorporating a LLC in United States America if you're not a US citizen a limited liability company is a so-called pass-through entity or tax transparent vehicle that means the LLC itself is not being taxed in the United States but the tax obligations are being passed through shooty respective owners if you as a non-us citizen and a non-resident a so-called non-resident alien incorporate a LLC United States and then have a personal residency either in a country it charges very little tax or a country that has a territorial basic sation system that doesn't change any tax on foreign earned income or your perpetual traveler and you're a resident of nowhere then you can legally operate a business that can get all the payment processing you ever want stripe papal Braintree you can get good banking with solid banks you get banking with all sorts of neo bangs that transferwise or mercury and you can make that money completely tax-free because the United States doesn't text you as long as you don't have economic substance in the United States meaning employees and offer or something like that any any kind of assets and your personal taxes your personal tax residency also doesn't charge you any type of personal income tax so now you have the best of both worlds you have a rigorous diction with a very high reputation solid banking you can give your customers invoices that they have no issues deducting in their local high tech jurisdictions but at the same time your personal tax load is zero this is probably one of the best set ups right now it's very cost effective to set up it's very cost effective to maintain it's very easy to set up you don't require a lot of documentation you don't require utility bills and this is probably a setup that many of you can really put to a great effect if you need further in term a information about how exactly to set this up where do you go what what company to use to set this up how to get all of the documents in order then send me a send me an email to the email address below this video and I can help you to guide you through this process this is Chris from offshore secrets I hope you liked this video please subscribe and I see you on the next video

Thanks for your comment Kristi Maltbia, have a nice day.

- Shawanna Mcbath, Staff Member

Comment by abstreci

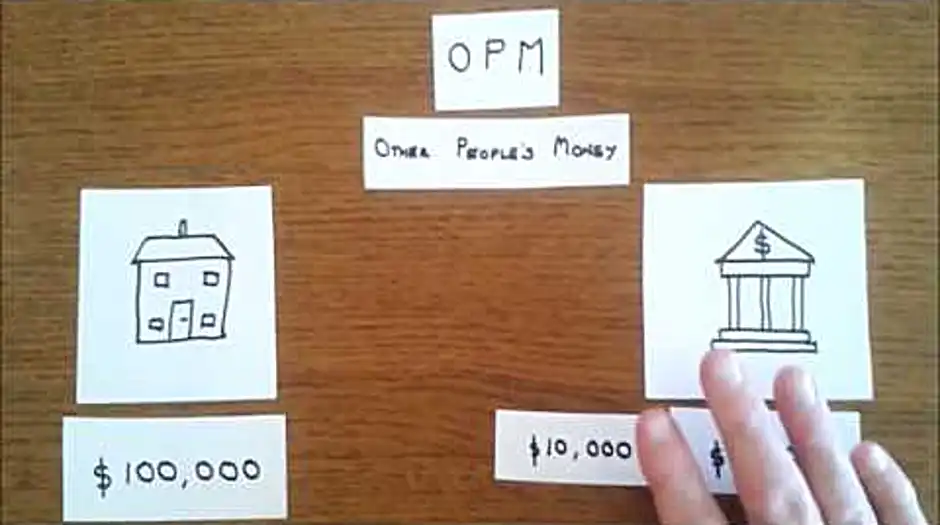

today I thought we'd look at the subject of OPM or other people's Manning and more importantly using other people's money so let's say you bought a house and it costs you $100,000 now most people haven't got $100,000 so they would tend to go to a bank who would give them a mortgage of staying $90,000 and they put in ten thousand dollars of their own money now let's say at a later date you sold your house it's a growing value to one hundred and fifty thousand dollars so now you've made fifty thousand dollars profit you would give the bank back ninety thousand dollars pay off your mortgage and you'd still get your ten thousand dollars back as well as the fifty thousand dollars profit the question is does the bank want any of that $50,000 profit and the answer's no you've used other people's money the banks to make fifty thousand dollars looking at how good the investment is if you'd have spent a hundred thousand dollars buying the house outright and then made fifty thousand dollars when you sold it you've made fifty percent profit which is quite good but if you've got a mortgage and only spent ten thousand dollars of your own money making $50,000 from ten thousand dollars is phenomenal it's ten times as much so the idea is using other people's money really is the way to go so if you've bought your house for ten thousand dollars down what's to stop you buying another house for another ten thousand dollars down well theoretically nothing you just got to convince your bank that you can pay the mortgage payments these people that are in this situation tend to live in one house and rent the other one out and on the second property using other people's money again the banks again you can just convince them that you can cover any mortgage payment and expenses by what you charge your tenants now remember there is a downside to all of this and that is expenses each house will have its own mortgage payment its own utilities to pay any maintenance and the thing that you tend to forget the tax would have to be declared in your tax return on any income now let's try another example say for instance you want to buy some shares with your ten thousand dollars instead of property now if you poke your bank and say can I borrow some money to buy some more shares your bank will say no because the thing is shares are not tangible if it was a house it could take your house away from you if you defaulted on the mortgage payment so it seems like the bank will only lend on certain types of assets ie tangible assets so there it is an introduction to OPM or other people's money

Thanks abstreci your participation is very much appreciated

- Shawanna Mcbath

About the author

Shawanna Mcbath

I've studied development geography at University of Providence in Great Falls and I am an expert in mycology. I usually feel groggy. My previous job was systems analyst, data processing I held this position for 31 years, I love talking about sudoku and watching documentaries. Huge fan of Mike Tyson I practice boxing and collect fabric and textiles.

Try Not to laugh !

Joke resides here...

Tags

What part of my OPM annuity is taxable

What is Box 5 on OPM 1099-R

What is the taxable amount on a 1099-R

Can I view my 1099-R online

What do I do if I don t receive my 1099

How do I know if my 1099 was issued

Does the IRS audit 1099s

Will the IRS let me know if I made a mistake

What happens if I don t report my 1099 NEC

Who gets Form 1099

Who produces 1099-R

How does the IRS find out about unreported income

Why does my 1099-R Say unknown in box 2a

How do I get my 1099-R

Will the IRS catch a missing 1099-R

Can I file my taxes without my 1099-R

How do I get my 1099-R from OPM

What is the penalty for not filing a 1099-R

When should I receive 1099-R

: 5000

: 5000